Utility Users Tax Refund Claim Form - City Of San Jose Page 3

ADVERTISEMENT

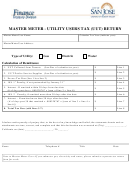

COMPLETED CLAIMS FOR TAX REFUND AND SUPPORTING DOCUMENTATION MUST

BE FILED WITH: CITY OF SAN JOSE, REVENUE MANAGEMENT, FINANCE,

th

200 E. SANTA CLARA STREET, 4

FLOOR TOWER, SAN JOSE, CA, 95113-1905

INSTRUCTIONS FOR FILING A CLAIM FOR TAX REFUND

(CHAPTER 4.82 AND 4.68 OF THE SAN JOSE MUNICIPAL CODE)

Failure to complete all sections of the claim form could delay the processing of your claim and could result in

the return or denial of your claim. Please note the deadline for submission of the claim on the front page of the

Claim Form. Untimely claims will be returned.

A separate claim form must be filed for the refund of the tax paid to each utility company. For example, if a claimant is

seeking a refund of the telephone utility users tax, the claimant must file a separate claim form for the refund of the tax

collected by each service provider with whom the claimant has an account.

1. Claimant’s Information— Complete all of the information required in this section. ALL OFFICIAL

CORRESPONDENCE WILL BE SENT TO THE BUSINESS OR PERSON LISTED AT THE MAILING ADDRESS.

2. Basis of Claim — State in detail all facts supporting your claim that the tax was overpaid, paid more than once, or

erroneously or illegally collected or received by the City of San José. Submit copies of all cancelled checks, receipts

and any other document or record which supports your claim for a refund. Please attached additional sheets as

necessary.

3. Refund Amount and Payment Information — State the total amount you are claiming as a tax refund and the

date(s) of payment. Please also state to whom the refund check is to be paid.

4. Signature of Claimant or Representative — Please sign and date. Print name of signatory, and the position, title or

other relationship to claimant. The claim must be signed by the taxpayer the taxpayer’s guardian, conservator,

executor or administrator. No other agent, including the taxpayer’s attorney, may sign a tax refund claim. The City

will not accept the claim without the original signature. (A photostatic or facsimile copy will not be accepted.) If the

signatory is the guardian, conservator, executor or administrator, the City may require proof of such relationship

before processing any refund.

WARNING: IT IS A CRIMINAL OFFENSE TO FILE A FALSE CLAIM (CALIFORNIA PENAL CODE

SECTION 72).

T-9137.001\364866_2.doc

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3