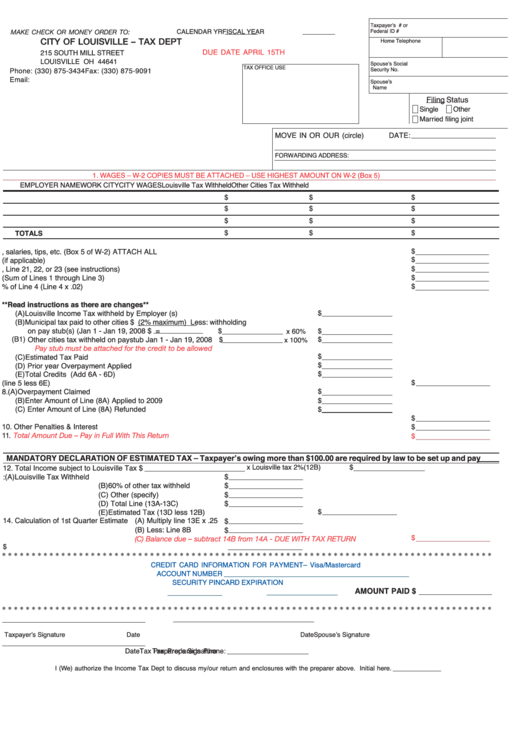

Ohio Tax Form - City Of Louisville - Tax Dept

ADVERTISEMENT

Taxpayer’s S.S. # or

CALENDAR YR

FISCAL YEAR

Federal ID #

MAKE CHECK OR MONEY ORDER TO:

CITY OF LOUISVILLE – TAX DEPT

Home Telephone No.

Business Telephone No.

DUE DATE APRIL 15TH

215 SOUTH MILL STREET

LOUISVILLE OH 44641

Spouse’s Social

TAX OFFICE USE

Security No.

Phone: (330) 875-3434 Fax: (330) 875-9091

Email:

Spouse’s

Name

Filing Status

Single

Other

Married filing joint

MOVE IN OR OUR (circle)

DATE:

FORWARDING ADDRESS:

1. WAGES – W-2 COPIES MUST BE ATTACHED – USE HIGHEST AMOUNT ON W-2 (Box 5)

EMPLOYER NAME

WORK CITY

CITY WAGES

Louisville Tax Withheld

Other Cities Tax Withheld

$

$

$

$

$

$

$

$

$

$

$

$

TOTALS

$

1. Wages, salaries, tips, etc. (Box 5 of W-2) ATTACH ALL

$

2. Federal Form 2106 Deduction (if applicable)

$

3. Adjustments from Page 2, Line 21, 22, or 23 (see instructions)

4. Taxable Income (Sum of Lines 1 through Line 3)

$

5. Louisville Income Tax 2% of Line 4 (Line 4 x .02)

$

6. Credits **Read instructions as there are changes**

(A) Louisville Income Tax withheld by Employer (s)

$

(B) Municipal tax paid to other cities $

(2% maximum) Less: withholding

on pay stub(s) (Jan 1 - Jan 19, 2008 $

=

$

x 60%

$

(B1)

Other cities tax withheld on paystub Jan 1 - Jan 19, 2008

$

$

x 100%

Pay stub must be attached for the credit to be allowed

$

(C) Estimated Tax Paid

$

(D) Prior year Overpayment Applied

(E) Total Credits (Add 6A - 6D)

$

7. Tax Due (line 5 less 6E)

$

$

8. (A) Overpayment Claimed

(B) Enter Amount of Line (8A) Applied to 2009

$

(C) Enter Amount of Line (8A) Refunded

$

9. Late Filing Fee

$

10. Other Penalties & Interest

$

11.

Total Amount Due – Pay in Full With This Return

$

MANDATORY DECLARATION OF ESTIMATED TAX – Taxpayer’s owing more than $100.00 are required by law to be set up and pay

12. Total Income subject to Louisville Tax $

x Louisville tax 2%

(12B)

$

(A) Louisville Tax Withheld

$

13. Estimate Credits:

(B) 60% of other tax withheld

$

(C) Other (specify)

$

(D) Total Line (13A-13C)

$

$

(E) Estimated Tax (13D less 12B)

14. Calculation of 1st Quarter Estimate

(A) Multiply line 13E x .25

$

(B) Less: Line 8B

$

$

(C) Balance due – subtract 14B from 14A - DUE WITH TAX RETURN

$

15. Balance of estimate to be billed quarterly Line 14A x 3

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

CREDIT CARD INFORMATION FOR PAYMENT– Visa/Mastercard

ACCOUNT NUMBER

SECURITY PIN

CARD EXPIRATION

AMOUNT PAID $

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

Taxpayer’s Signature

Date

Spouse’s Signature

Date

Tax Preparer’s Signature

Date

Tax Preparer’s Phone:

I (We) authorize the Income Tax Dept to discuss my/our return and enclosures with the preparer above. Initial here.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2