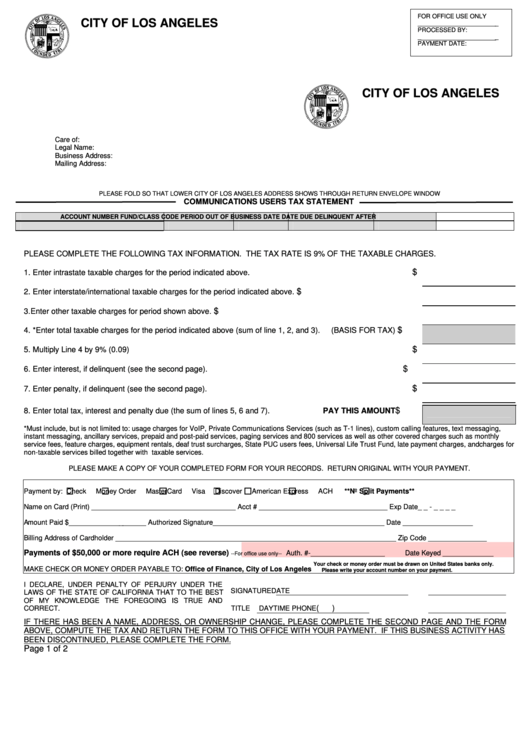

Communications Users Tax Statement - City Of Los Angeles

ADVERTISEMENT

FOR OFFICE USE ONLY

CITY OF LOS ANGELES

________________________

PROCESSED BY:

________________________

PAYMENT DATE:

CITY OF LOS ANGELES

Care of:

Legal Name:

Business Address:

Mailing Address:

PLEASE FOLD SO THAT LOWER CITY OF LOS ANGELES ADDRESS SHOWS THROUGH RETURN ENVELOPE WINDOW

COMMUNICATIONS USERS TAX STATEMENT

ACCOUNT NUMBER

FUND/CLASS CODE

PERIOD

OUT OF BUSINESS DATE

DATE DUE

DELINQUENT AFTER

PLEASE COMPLETE THE FOLLOWING TAX INFORMATION. THE TAX RATE IS 9% OF THE TAXABLE CHARGES.

$

1. Enter intrastate taxable charges for the period indicated above.

$

2. Enter interstate/international taxable charges for the period indicated above.

$

3. Enter other taxable charges for period shown above.

$

4. *Enter total taxable charges for the period indicated above (sum of line 1, 2, and 3).

(BASIS FOR TAX)

$

5. Multiply Line 4 by 9% (0.09)

$

6. Enter interest, if delinquent (see the second page).

$

7. Enter penalty, if delinquent (see the second page).

$

8. Enter total tax, interest and penalty due (the sum of lines 5, 6 and 7).

PAY THIS AMOUNT

*Must include, but is not limited to: usage charges for VoIP, Private Communications Services (such as T-1 lines), custom calling features, text messaging,

instant messaging, ancillary services, prepaid and post-paid services, paging services and 800 services as well as other covered charges such as monthly

service fees, feature charges, equipment rentals, deaf trust surcharges, State PUC users fees, Universal Life Trust Fund, late payment charges, and charges for

non-taxable services billed together with taxable services.

PLEASE MAKE A COPY OF YOUR COMPLETED FORM FOR YOUR RECORDS. RETURN ORIGINAL WITH YOUR PAYMENT.

Payment by:

Check

Money Order

MasterCard

Visa

Discover

American Express

ACH

**No Split Payments**

Name on Card (Print) _____________________________________

Acct # _________________________________

Exp Date_ _ - _ _ _ _

Amount Paid $____________________

Authorized Signature____________________________________________

Date __________________

Billing Address of Cardholder ________________________________________________________________________

Zip Code _______________

Payments of $50,000 or more require ACH (see reverse)

Auth. #-___________________

Date Keyed _____________

--For office use only--

Your check or money order must be drawn on United States banks only.

MAKE CHECK OR MONEY ORDER PAYABLE TO: Office of Finance, City of Los Angeles

Please write your account number on your payment.

I DECLARE, UNDER PENALTY OF PERJURY UNDER THE

SIGNATURE

DATE

LAWS OF THE STATE OF CALIFORNIA THAT TO THE BEST

OF MY KNOWLEDGE THE FOREGOING IS TRUE AND

(

)

CORRECT.

TITLE

DAYTIME PHONE

IF THERE HAS BEEN A NAME, ADDRESS, OR OWNERSHIP CHANGE, PLEASE COMPLETE THE SECOND PAGE AND THE FORM

ABOVE, COMPUTE THE TAX AND RETURN THE FORM TO THIS OFFICE WITH YOUR PAYMENT. IF THIS BUSINESS ACTIVITY HAS

BEEN DISCONTINUED, PLEASE COMPLETE THE FORM.

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2