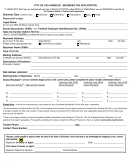

Communications Users Tax Statement - City Of Los Angeles Page 2

ADVERTISEMENT

TAX OR FEE IS NOW DUE

MAIN OFFICE

City Hall (Use Main St. Entrance)

200 N. Spring Street

Rm. 101

PHONE (213) 473-5901

Open Mon. through Fri.

8 AM to 5 PM

BRANCH OFFICES

Van Nuys Civic Center

6262 Van Nuys Blvd.

Rm. 110

PHONE (818) 374-6850

Open Mon. through Fri.

8 AM to 5 PM

Braude Constituent Services Center

West Los Angeles

1828 Sawtelle Blvd.

Rm. 102

PHONE (310) 575-8888

Open Mon. through Fri.

8 AM to 5 PM

Hollywood

6501 Fountain Ave.

PHONE (213) 485-3935

Open Mon. through Fri.

8 AM to 5 PM

(213) 485-6305

San Pedro

638 S. Beacon Street

Rm. 211

PHONE (310) 732-4537

Open Mon., Wed., Fri.

7:30 AM to 12 Noon

1 PM to 4:30 PM

Westchester Municipal Building

7166 W. Manchester Ave.

Rm. 9

PHONE (213) 473-6750

Open Tues., Thurs.

8 AM to 12 Noon

Watts Civic Center Building

10221 Compton Ave.

Rm. 202

PHONE (213) 473-5109

Open Tues., Thurs.

1 PM to 4:30 PM

RD

Figueroa Plaza Building

201 N. Figueroa St.

3

Floor

PHONE (213) 482-7032

Open Mon., Tue., Thu., Fri.

7:30 AM to 4:30 PM

One Stop Permitting Center

Counter 17

Wed.

9 AM to 4:30 PM

IMPORTANT INFORMATION

ARTICLE 1.1 of the L.A.M.C.

Visit the Office of Finance website at , or contact us at

for more information.

The person(s) providing information regarding the supply of communications services subject to the tax must collect taxes imposed by Article 1.1 of the Los

Angeles Municipal Code from service users. Communications service providers must report and remit the tax on either their charges paid or their

charges billed, depending on their previously selected method. The tax period, due and delinquent dates are based on these methods. When

collections are not remitted to the City of Los Angeles, Office of Finance before the delinquent date, interest and penalties accrue as follows:

INTEREST – If any tax due for a month is not paid in one of the offices listed above by 5 P.M. (or postmarked by the U.S. Post Office by 11:59 P.M., if mailed)

by the due date, interest at the rate of 0.3% per month shall apply to the principal tax due until paid. Interest applies only to the principal tax due and not to

any penalty incurred for delinquency.

PENALTY-- If any tax due for a month is not paid in one of the offices listed above by 5 P.M. (or postmarked by the U.S. Post Office by 11:59 P.M., if mailed) by

nd

rd

the due date, a penalty of 5% of the principal tax due shall apply. A penalty of 10% applies to the 2

month of delinquency, 15% applies to the 3

month of

th

delinquency, and 20% applies to the 4

month. An additional penalty of 20% of the tax due shall apply if payment is not made on or before the last day of the

fourth month following the imposition of the first penalty. Penalty applies only to the principal tax due, and not to any interest incurred for delinquency.

Please note that on September 25, 2004 Ordinance #176160 became effective requiring all tax payments of $50,000 or more to be made by electronic funds

transfers. You must pre-register in order to make payment by means of electronic funds transfers. Please call (213) 922-9690 for further information.

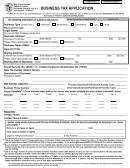

CHECK APPROPRIATE STATEMENT

(a)

LEGAL NAME CHANGE

DATE

(

)

IF THIS IS AN OWNERSHIP CHANGE, NEW OWNER’S PHONE NUMBER

(b)

BUSINESS ADDRESS

DATE

CITY

STATE

ZIP

IS THIS A RESIDENTIAL ADDRESS (Y/N)?

IS THIS ADDRESS LOCATED OUTSIDE THE UNITED STATES (Y/N)?

(c)

DBA (DOING BUSINESS AS)

DATE

(d)

MAILING ADDRESS

DATE

CITY

STATE

ZIP

C/O

IS THIS A RESIDENTIAL ADDRESS (Y/N)?

IS THIS ADDRESS LOCATED OUTSIDE THE UNITED STATES (Y/N)?

(e)

ALL RENTAL PROPERTIES SOLD

DATE

(f)

ENTIRE BUSINESS (ES) SOLD OR DISCONTINUED

DATE

(g)

INDIVIDUAL BUSINESS ACTIVITY SOLD OR DISCONTINUED

CLASS CODE (S)

DATE

(h)

PORTION OF BUSINESS ACTIVITY SOLD OR TRANSFERRED

CLASS CODE (S)

DATE

(i)

IF YOU RELOCATED ALL OR PART OF YOUR BUSINESS OUT OF THE CITY OF LOS ANGELES, STATE REASON(S) HERE:

Page 2 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2