Application For Extension Of Time To File City Of Troy Business Income Tax Return

ADVERTISEMENT

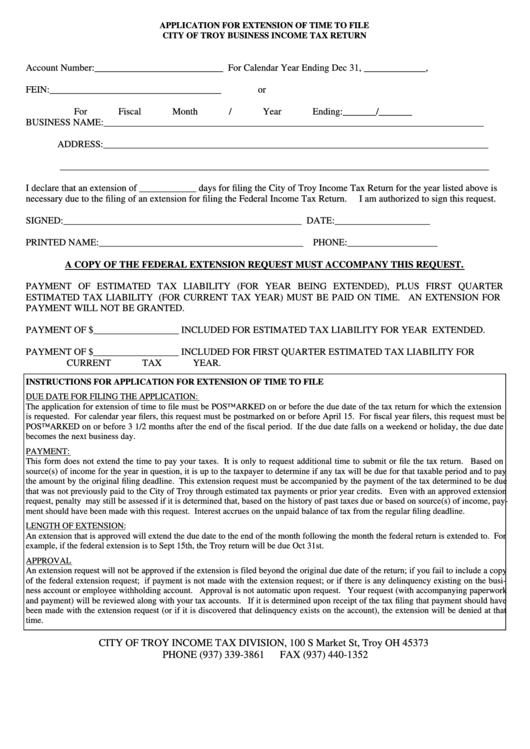

APPLICATION FOR EXTENSION OF TIME TO FILE

CITY OF TROY BUSINESS INCOME TAX RETURN

Account Number:___________________________

For Calendar Year Ending Dec 31, _____________,

FEIN:____________________________________

or

For Fiscal Month / Year Ending:_______/_______

BUSINESS NAME:________________________________________________________________________________

ADDRESS:_________________________________________________________________________________

__________________________________________________________________________________________

I declare that an extension of ____________ days for filing the City of Troy Income Tax Return for the year listed above is

necessary due to the filing of an extension for filing the Federal Income Tax Return.

I am authorized to sign this request.

SIGNED:__________________________________________________ DATE:____________________

PRINTED NAME:___________________________________________ PHONE:___________________

A COPY OF THE FEDERAL EXTENSION REQUEST MUST ACCOMPANY THIS REQUEST.

PAYMENT OF ESTIMATED TAX LIABILITY (FOR YEAR BEING EXTENDED), PLUS FIRST QUARTER

ESTIMATED TAX LIABILITY (FOR CURRENT TAX YEAR) MUST BE PAID ON TIME.

AN EXTENSION FOR

PAYMENT WILL NOT BE GRANTED.

PAYMENT OF $__________________ INCLUDED FOR ESTIMATED TAX LIABILITY FOR YEAR EXTENDED.

PAYMENT OF $__________________ INCLUDED FOR FIRST QUARTER ESTIMATED TAX LIABILITY FOR

CURRENT TAX YEAR.

INSTRUCTIONS FOR APPLICATION FOR EXTENSION OF TIME TO FILE

DUE DATE FOR FILING THE APPLICATION:

The application for extension of time to file must be POSTMARKED on or before the due date of the tax return for which the extension

is requested. For calendar year filers, this request must be postmarked on or before April 15. For fiscal year filers, this request must be

POSTMARKED on or before 3 1/2 months after the end of the fiscal period. If the due date falls on a weekend or holiday, the due date

becomes the next business day.

PAYMENT:

This form does not extend the time to pay your taxes. It is only to request additional time to submit or file the tax return. Based on

source(s) of income for the year in question, it is up to the taxpayer to determine if any tax will be due for that taxable period and to pay

the amount by the original filing deadline. This extension request must be accompanied by the payment of the tax determined to be due

that was not previously paid to the City of Troy through estimated tax payments or prior year credits. Even with an approved extension

request, penalty may still be assessed if it is determined that, based on the history of past taxes due or based on source(s) of income, pay-

ment should have been made with this request. Interest accrues on the unpaid balance of tax from the regular filing deadline.

LENGTH OF EXTENSION:

An extension that is approved will extend the due date to the end of the month following the month the federal return is extended to. For

example, if the federal extension is to Sept 15th, the Troy return will be due Oct 31st.

APPROVAL

An extension request will not be approved if the extension is filed beyond the original due date of the return; if you fail to include a copy

of the federal extension request; if payment is not made with the extension request; or if there is any delinquency existing on the busi-

ness account or employee withholding account. Approval is not automatic upon request. Your request (with accompanying paperwork

and payment) will be reviewed along with your tax accounts. If it is determined upon receipt of the tax filing that payment should have

been made with the extension request (or if it is discovered that delinquency exists on the account), the extension will be denied at that

time.

CITY OF TROY INCOME TAX DIVISION, 100 S Market St, Troy OH 45373

PHONE (937) 339-3861

FAX (937) 440-1352

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1