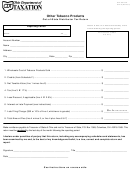

Filing instructions for OTP-906

Line 1:

(A) In-State Distributor - Indicate the total of all receipts (mfg. Wholesale price) from manufacturer,

other licensed distributors, or unlicensed distributors from Form OTP-907, Schedule A.

(B) Out-of-State Distributor - Indicate the total of all shipments (mfg. Wholesale price) shipped into

state from Form OTP-907, Schedule B.

Line 2:

Indicate the total of merchandise (mfg. Wholesale price) shipped out-of-state from Form OTP-907,

Schedule C.

Line 3:

Indicate the total of merchandise (mfg. Wholesale price) returned to manufacturers from Form OTP-907,

Schedule D. (A credit memo MUST be attached.)

Line 4:

Indicate the total of merchandise (mfg. Wholesale price) that was destroyed by distributor from Form

OTP-908.

Line 5:

Indicate the total of tax paid merchandise (Wholesale price) sold to Federal Government from Form

OTP-907, Schedule E.

Line 6:

Indicate the total of tax paid merchandise (Wholesale price) purchased from other licensed distributors

from Form OTP-907, Schedule F.

Line 7:

Enter bad debt amount form line 12 of Schedule OTP-BD.

Line : 8

Total lines 2 through 7.

Line 9:

Total Taxable Tobacco: Line 1 minus Line 8.

Line 10:

Tax Due, Multiply Line 9 by twenty-four percent (24%).

Line 11:

Collection Allowance: Multiply Line 9 by sixtenths of one percent (.6%).

Line 12:

This is the tax due or refund. Line 10 minus Line 11.

Line 13:

Penalty for late filed reports. Penalty is ten percent (10%) of the total tax due or five dollars ($5.00),

whichever is greater. On a late report with no tax liability the penalty is five dollars ($5.00).

Line 14:

Interest due on late filed reports. To calculate interest on a delinquent report, multiply the tax due by the

current annual rate. Divide by 365 and multiply by the number of days late.

Line 15:

Refund claimed for this particular month. There are no carry forward of refunds. If a refund is due to a bad

debt, attach verification and complete refund form GA-110L.

Line 16:

Total Tax Due: Line 12 + 13 + 14. Enclose your remittance for this amount. Make check payable to

“Indiana Department of Revenue.”

I.C. 6-7-2 Chapter 2 Section 6: “Wholesale Price” means the price at which the manufacturer of the tobacco products

sells to distributors excluding any discount or other reduction. (Free goods must be included in total invoice price).

For questions related to this form, email: INCigTax@dor.in.gov

or call (317) 615-2710

1

1 2

2