Form 32-022a - Iowa Sales/retailer'S Use Tax Return

ADVERTISEMENT

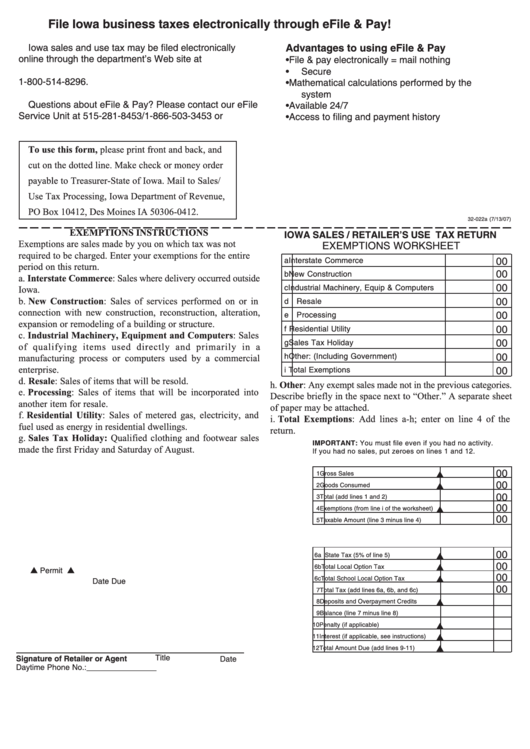

File Iowa business taxes electronically through eFile & Pay!

Iowa sales and use tax may be filed electronically

Advantages to using eFile & Pay

online through the department’s Web site at

•

File & pay electronically = mail nothing

or by touch-tone telephone at

•

Secure

1-800-514-8296.

•

Mathematical calculations performed by the

system

Questions about eFile & Pay? Please contact our eFile

•

Available 24/7

Service Unit at 515-281-8453/1-866-503-3453 or

•

Access to filing and payment history

idrefile@iowa.gov

To use this form, please print front and back, and

cut on the dotted line. Make check or money order

payable to Treasurer-State of Iowa. Mail to Sales/

Use Tax Processing, Iowa Department of Revenue,

PO Box 10412, Des Moines IA 50306-0412.

32-022a (7/13/07)

EXEMPTIONS INSTRUCTIONS

IOWA SALES / RETAILER’S USE TAX RETURN

Exemptions are sales made by you on which tax was not

EXEMPTIONS WORKSHEET

required to be charged. Enter your exemptions for the entire

00

a Interstate Commerce

period on this return.

00

b New Construction

a. Interstate Commerce: Sales where delivery occurred outside

00

c Industrial Machinery, Equip & Computers

Iowa.

b. New Construction: Sales of services performed on or in

00

d Resale

connection with new construction, reconstruction, alteration,

00

e Processing

expansion or remodeling of a building or structure.

00

f

Residential Utility

c. Industrial Machinery, Equipment and Computers: Sales

00

g Sales Tax Holiday

of qualifying items used directly and primarily in a

00

h Other: (Including Government)

manufacturing process or computers used by a commercial

enterprise.

00

i

Total Exemptions

d. Resale: Sales of items that will be resold.

h. Other: Any exempt sales made not in the previous categories.

e. Processing: Sales of items that will be incorporated into

Describe briefly in the space next to “Other.” A separate sheet

another item for resale.

of paper may be attached.

f. Residential Utility: Sales of metered gas, electricity, and

i. Total Exemptions: Add lines a-h; enter on line 4 of the

fuel used as energy in residential dwellings.

return.

g. Sales Tax Holiday: Qualified clothing and footwear sales

IMPORTANT: You must file even if you had no activity.

made the first Friday and Saturday of August.

If you had no sales, put zeroes on lines 1 and 12.

00

1 Gross Sales

00

2 Goods Consumed

00

3 Total (add lines 1 and 2)

00

4 Exemptions (from line i of the worksheet)

00

5 Taxable Amount (line 3 minus line 4)

00

6a State Tax (5% of line 5)

00

6b Total Local Option Tax

Permit No.

Period

00

6c Total School Local Option Tax

Date Due

00

7 Total Tax (add lines 6a, 6b, and 6c)

8 Deposits and Overpayment Credits

9 Balance (line 7 minus line 8)

10 Penalty (if applicable)

11 Interest (if applicable, see instructions)

12 Total Amount Due (add lines 9-11)

Title

Signature of Retailer or Agent

Date

Daytime Phone No.: ________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2