Form Ptax-340 General Information/instructions - 2005 Page 2

ADVERTISEMENT

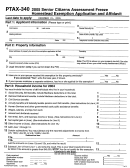

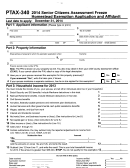

Form PTAX-340 Step-by-Step Instructions

To determine the total amount of the household benefits, multiply

Part 1: Applicant information

the monthly amount each person received by 12. You must adjust

Lines 1 through 5 — Type or print the requested information.

your figures accordingly if anyone in the household did not receive

12 equal checks during this period.

Part 2: Property information

Food stamps, medical assistance, and Circuit Breaker benefits

anyone in the household may have received are not considered

Lines 1 through 3 — Identify the property for which this

income and should not be added to your total income.

application is filed. Complete Line 3 only if you do not know

Line 6 — Wages, salaries, and tips from work

your PIN.

Write the total amount of wages, salaries, and tips from work for

Lines 4 and 5 — Answer the questions by marking an “X” next

every household member (shown in box 1 of Form W-2).

to your response. If you answered “Yes” to the question in Line 4

and you know the base year, write it in the space provided.

Line 7 — Interest and dividends received

Write the total amount of interest and dividends the entire house-

Part 3: Household income for 2005

hold received from all sources, including any government sources

(shown on Forms 1099-INT, 1099-OID, and 1099-DIV). You must

“Income” for this exemption means 2005 federal adjusted gross

include both taxable and nontaxable amounts.

income, plus certain items subtracted from or not included in your

Line 8 — Net rental, farm, and business income or (loss)

federal adjusted gross income (320 ILCS 25/3.07). These include

Write the total amount of net income or loss from rental, farm,

tax-exempt interest, dividends, annuities, net operating loss

carryovers, capital loss carryovers, and Social Security benefits.

business sources, etc., the entire household received, as allowed

on U.S. 1040, Lines 12, 17, and 18. You cannot use any net

Income also includes public assistance payments from a govern-

operating loss (NOL) carryover in figuring income.

mental agency, Supplemental Security Income, and certain taxes

paid. These Step-by-Step instructions provide federal return line

Line 9 — Net capital gain or (loss)

references and reporting statement references, whenever possible.

Write the total amount of taxable capital gain or loss the entire

The amounts written on each line must include your 2005 income

household received in 2005, as allowed on U.S. 1040, Lines 13 and

and the 2005 income of all the individuals living in the household.

14, or U.S. 1040A, Line 10. You cannot use a net capital loss

carryover in figuring income.

Line 1 — Social Security and Supplemental Security

Income (SSI) benefits

Line 10 — Other income or (loss)

Write the total amount of retirement, disability, or survivor’s

Write the total amount of other income or loss not included in Lines

benefits (including Medicare deductions) the entire household

1 through 9, that is included in federal adjusted gross income, such

received from the Social Security Administration (shown in box 3

as alimony received, unemployment compensation, taxes withheld

of Form SSA-1099). You also must include any Supplemental

from oil or gas well royalties. You cannot use any net operating loss

Security Income (SSI) the entire household received and any

(NOL) carryover in figuring income.

benefits to dependent children in the household. Do not include

Line 11

— Add Lines 1 through 10.

reimbursements under Medicare/Medicaid for medical expenses.

Line 12 — Subtractions

Note: The amount deducted for Medicare ($938.40 yearly or

You may subtract only the reported adjustments to income totaled

$78.20 per month, per person) is already included in the amount

on U.S. 1040, Line 36 or U.S. 1040A, Line 20. For example

in box 3 of Form SSA-1099.

• educator expenses

Line 2 — Railroad Retirement benefits

• IRA deduction

Write the total amount of retirement, disability, or survivor’s

• student loan interest deduction

benefits (including Medicare deductions) the entire household

• tuition and fees deduction

received under the Railroad Retirement Act (shown on

• Archer MSA deduction

Forms SSA-1099 and RRB-1099).

• moving expenses

Line 3 — Civil Service benefits

• one-half of self-employment tax

• self-employed health insurance deduction

Write the total amount of retirement, disability, or survivor’s

• self-employed SEP, SIMPLE, and qualified plans

benefits the entire household received under any Civil Service

• penalty on early withdrawal of savings

retirement plan (shown on Form 1099-R).

• alimony paid

Line 4 — Other pensions and annuity benefits

Line 13 — Total household income

Write the total amount of income the entire household received as

Subtract Line 12 from Line 11. If this amount is greater than

an annuity from any annuity, endowment, life insurance contract,

$45,000, you do not qualify for this exemption.

or similar contract or agreement (shown on Form 1099-R).

Include only the federally taxable portion of pensions, IRAs, and

Part 4: Affidavit

IRAs converted to Roth IRAs (shown on U.S. 1040, Line 15b and

16b, or U.S. 1040A, Line 11b and 12b). IRA’s are not taxable

Lines 1 through 4 — Mark the item that applies. Read the affidavit

when “rolled over,” unless “rolled over” into a Roth IRA.

carefully. The statements must apply.

Line 7 — Write the names and tax identification numbers of the

Line 5 — Human Services and other governmental

individuals, other than yourself, who used the property for their

cash public assistance benefits

principal residence on January 1, 2006. Attach an additional sheet if

Write the total amount of Human Services and other governmen-

necessary.

tal cash public assistance benefits the entire household received.

If the first two digits of any member’s Human Services case

Line 8 — Follow the instructions on the form. If your spouse does

number are the same as any of those in the following list, you

not reside at this property, be sure to write his or her name and

must include the total amount of any of these benefits on Line 5.

address.

01 aged

04 and 06 temporary assistance to

Note: You must sign your Form PTAX-340 and have it notarized

02 blind

needy families (TANF)

before you file it with your CCAO. Return your completed

03 disabled

07 general assistance

Form PTAX-340 to your CCAO at the address printed on the

bottom of Page 2.

4 of 4

PTAX-340 (R-12/05)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2