Instructions For Form Ct-G Es

ADVERTISEMENT

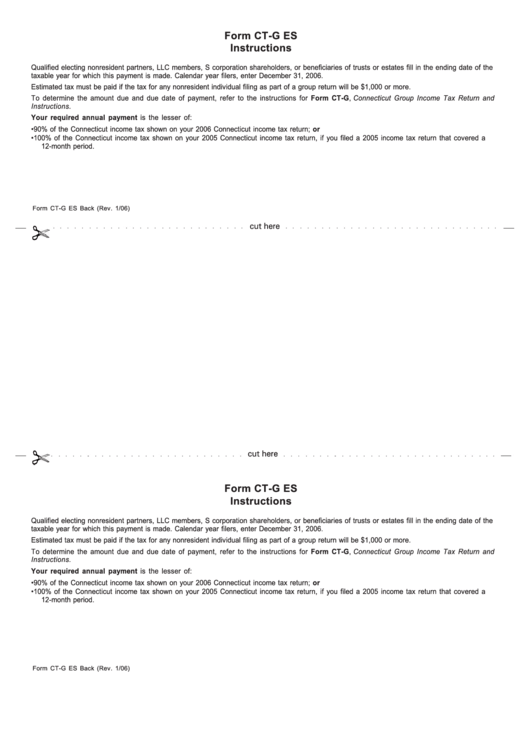

Form CT-G ES

Instructions

Qualified electing nonresident partners, LLC members, S corporation shareholders, or beneficiaries of trusts or estates fill in the ending date of the

taxable year for which this payment is made. Calendar year filers, enter December 31, 2006.

Estimated tax must be paid if the tax for any nonresident individual filing as part of a group return will be $1,000 or more.

To determine the amount due and due date of payment, refer to the instructions for Form CT-G, Connecticut Group Income Tax Return and

Instructions.

Your required annual payment is the lesser of:

•

90% of the Connecticut income tax shown on your 2006 Connecticut income tax return; or

•

100% of the Connecticut income tax shown on your 2005 Connecticut income tax return, if you filed a 2005 income tax return that covered a

12-month period.

Form CT-G ES Back (Rev. 1/06)

cut here

cut here

Form CT-G ES

Instructions

Qualified electing nonresident partners, LLC members, S corporation shareholders, or beneficiaries of trusts or estates fill in the ending date of the

taxable year for which this payment is made. Calendar year filers, enter December 31, 2006.

Estimated tax must be paid if the tax for any nonresident individual filing as part of a group return will be $1,000 or more.

To determine the amount due and due date of payment, refer to the instructions for Form CT-G, Connecticut Group Income Tax Return and

Instructions.

Your required annual payment is the lesser of:

•

90% of the Connecticut income tax shown on your 2006 Connecticut income tax return; or

•

100% of the Connecticut income tax shown on your 2005 Connecticut income tax return, if you filed a 2005 income tax return that covered a

12-month period.

Form CT-G ES Back (Rev. 1/06)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2