Form Rev-181 Cm - Application For Tax Clearance Certificate - 2008 Page 3

ADVERTISEMENT

1810008301

Page 3

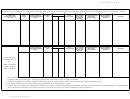

Number of employees and total gross payrolls during the last five operating years (as reported to the Social Security Administration):

17

YEAR

TOTAL EMPLOYEES

PA

TOTAL GROSS

PA

EMPLOYEES

PAYROLL

GROSS PAYROLL

18

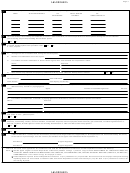

Have the officers received any remuneration, in cash or other other form, for services performed in Pennsylvania during the current calendar

year or during any of the preceding four calendar years?

Yes

No

Were any remunerated services performed for the business in PA, which you believe did not constitute “employment” as defined

19

in the PA Unemployment Compensation Law?

Yes

No

If “Yes”, explain:

20

A.

Average number of stockholders during the last five years:

B.

Number of stockholders as of this report:

C.

List names and home addresses of stock transfer agents who have handled the corporation’s stock:

Name:

Address:

D.

Were all shares presented and property redeemed from any stock called for redemption or retired?

Yes

No

The figures below must agree with the last corporate tax report filed with the PA Department of Revenue.

21

Date of Report:

Total Liabilities:

Total Assets:

Total Equity (net worth):

A.

List the amount of corporate bonds issued and still outstanding as of this report. Show each issue separately and include name and

22

address of any transfer or paying agents.

Issue

Agent

Number of Outstanding Bonds

Amount

B.

List names and addresses of transfer or paying agents not listed above who have handled corporate bond issues.

Name:

Address:

Have you consumed or used in Pennsylvania any tangible personal property or acquired such, after March 6, 1956, on which no PA Sales or Use Tax

23

was paid? If “Yes”, please explain:

Yes

No

Do you have within your custody, possession or control any abandoned and unclaimed (escheatable) funds or assets such as dividends, payroll,

24

deposits, outstanding checks, stock certificates, unidentified deposits, accounts payable debit balances, gift certificates, outstanding debentures or

interest, royalties, mineral rights or funds due missing shareholders or other unclaimed amounts payable?

Yes

No

Has the business filed a PA Abandoned and Unclaimed Property Report for the preceding year?

25

Yes

No

26

CERTIFICATION:

I certify that the information provided (including Schedules, if applicable) on this application has been examined by me and is,

to the best of my knowledge, true and correct. (Certification must agree with individuals listed in question 4.)

Print Name

Original Signature

Print Name

Original Signature

This form will serve as an application for clearances from both the PA Department of Revenue and PA Department of Labor and Industry.

G Submit typed original to the PA Department of Revenue (address on Page 1) and one copy to the PA DEPARTMENT OF LABOR AND INDUSTRY,

NOTE:

OFFICE OF UNEMPLOYMENT COMPENSATION TAX SERVICES, e-GOVERNMENT UNIT, LABOR & INDUSTRY BUILDING, ROOM 916, 651 BOAS ST.,

HARRISBURG PA 17121. Retain a copy for taxpayer’s record.

G Direct telephone inquiries to the PA Department of Revenue at (717) 783-6052 or at (717) 346-2001. Revenue services for taxpayer with special hearing

/speaking needs can be accessed at 1-800-447-3020. Call the PA Department of Labor and Industry at (717) 787-6637 or (717) 783-3545 for services for

the hearing impaired.

1810008301

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4