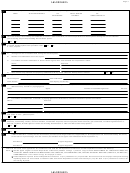

Form Rev-181 Cm - Application For Tax Clearance Certificate - 2008 Page 4

ADVERTISEMENT

SCHEDULE A - STATEMENT OF ACQUISITION AND/OR DISPOSITION OF PENNSYLVANIA REAL ESTATE WITHIN FIVE YEARS FROM THE DATE OF THIS APPLICATION

Name of Transferee (EE)

Original Cost

or Transferor (OR).

Date of

Property Location by

Acquisition

County

Actual Consider-

Actual Monetary Worth

Amount of PA Realty

Indicate each by symbol

Transfer

Local Political Subdivision

Date

Land

Building

Assessed Value

ation including

(Market Value)

Stamps Affixed to

Explanation

*

**

EE or OR.

& County

Encumbrance

at Time of Transfer

Document

*

Assumed

Original Cost

Property Location by

Acquisition

County

Actual Consider-

Actual Monetary Worth

Amount of PA Realty

Local Political Subdivision

Date

Land

Building

Assessed Value

ation including

(Market Value)

Stamps Affixed to

Explanation

*

**

& County

Encumbrance

at Time of Transfer

Document

*

Assumed

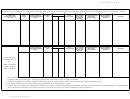

SCHEDULE B

STATEMENT OF

ALL

PENNSYLVANIA

REAL ESTATE

NOW OWNED

List all Real Estate now owned in PA that the business will dispose of prior to or at the time of the action for which a clearance is required.

If under agreement of disposition, attach copy of executed agreement for each property so affected.

* Complete if applicable. If transfer represents less than a full fee simple interest in the property, explain on a separate sheet of paper.

** If no Realty Transfer Tax was paid, explain on attached sheet or in “Explanation” column.

If application is for a Bulk Sale Clearance Certificate, attach a list of PA properties that will be retained. For each property, provide the complete address, including county,

date of acquisition and nature of property (residential, industrial, acreage, commercial or farmland). If none, state none.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4