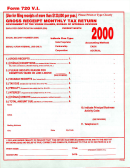

Form 300 - Gross Production Monthly Tax Report Page 2

ADVERTISEMENT

General Instructions

Who Must Report-

Every person, firm, association, or corporation responsible for paying or remitting the tax on the production from any lease shall file with the

Tax Commission a monthly report (Form 300) on each such lease regardless of sales or purchases of production there from during the reporting period.

Reporting Period -

Each calendar month is a reporting period.

Due Date of Report -

Reports are due on or before the twenty-fifth day of the second calendar month following the month of production. If reports are not re-

cieved on or before the due date they shall become delinquent and the Tax Commission may assess penalties as prescribed in 68 O.S. (Supp. 1983) Section 1010 (d).

Due Date of Remittance -

If remittance of taxes are not received on or before the twenty-fifth day of the second calendar month following the month of pro-

duction they shall become delinquent and the Tax Commission may assess interest and penalties as prescribed in 68 O.S. 1971 Sec. 217.

Instructions For Preparing Form 300

1.

Reporting party’s number assigned by Oklahoma Tax Commission.

2.

Reporting party’s Federal Employer Identification or Social Security number.

3.

A. Check appropriate box designating which type of report covered. (Separate report must be completed for each type of report.)

B. Check/Tracer Number:

1) Check Payment - Enter the last seven digits of the check number associated with the payment of taxes. If the check number is less than seven

digits, precede the number with zeroes (i.e. 0000123).

Note: When an underpayment of taxes occurs and a supplemental check is required, use the original check number for all reports.

2) EFT Payments - Enter 77777 plus the two digits of the most current production month (i.e. 7777701 for January production reports).

3) Wire Transfer Payments - Enter 44444 plus the two digits of the most current production month (i.e. 4444401 for January production reports).

4) Claim for Refund - Enter 9999999 as the trace number.

5) Zero Tax Due or Offsetting Reports - Enter 8888888 as the trace number.

Note: Offsetting reports are amended reports where taxes net to exactly zero (i.e. changing product codes, production unit numbers, months,

and/or county numbers.)

4.

Name of county which this report covers. (Separate report must be made for each county.)

5.

Classification of product being reported must be product code shown on OTC Form 320. (Separate report must be made for each product.)

Enter correct code number to show product being reported. Code numbers:

1. Oil

4. Casinghead Gas

6. Natural Gas Liquids

2. Condensate

5. Natural Gas

7. Minerals

6.

Month and year of production. (Separate report must be made for each month.)

7.

A. Number each page consecutively.

B. Type of report. Report Codes:

1. Original report

3. Corrected report.

Note: Credit out original entry with use of brackets and debit correct entry.

5. Production covered under a Small Business Incentive.

8.

For company use.

9.

Number used with the OTC Production Unit Number to designate separate line entries due to different contract prices.

10. Production Unit Number assigned to the lease by OTC, on Form 320.

11. If you are filing as operator give purchaser’s reporting number, or if you are filing as purchaser give operator’s reporting number.

12. Gross Volume (Gas to the nearest MCF at 14.65 pressure base: Oil to the nearest hundredth barrel).

13. Gross value. (Tax remitter should make an estimated report and remit taxes due for those months which he does not timely receive statements.)

14. Disposition of product being reported. Enter correct code number:

1. Transmission or Pipeline

2. Trucked

3. Gasoline Plant

4. Miscellaneous

15. BTU when reporting Gas.

16. Incentive Code for Reduced Tax Rate. If approved for Horizontal Incentive list 006; if approved for Ultra Deep Incentive 48 Month (15,000 feet to 17,499

feet) list 008; if approved for Ultra Deep Incentive 48 Month (17,500 feet or greater) list 009.

17. Gas Code:

1. Interstate

2. Intrastate

3. Mixed Stream

18. Gravity of oil produced from lease.

19. Tier category of oil produced: 1. Decontrolled

2. Lower 3. Upper

20. Oil Classification:

1. Sweet 2. Sour

21. Amount of Additional Value.

22. Amount of Tax Reimbursement (When not included in the contract price).

23. Exemption code:

1. State School Land Commission

4. City

*7. Frac Oil

10. State

2. Federal

5. School District

8. Other

11. OCC Authorized

3. County

6. Indian

9. OTC Assigned

*Frac affidavit must accompany this report. See Regulation No. 8-68.1001a-1(a).

24. Decimal equivalent of exempt interest. (7 positions)

25. Volume of exempt interest.

26. Value of exempt interest.

27. Taxable Volume. (Block 12 minus Block 25)

28. Taxable Value. (Block 13 plus Blocks 21 and 22 minus Block 26)

29. Gross Production Tax due on oil or gas for each entry. The applicable tax rate on oil and gas will also be posted on the Tax Commission internet website at

The Gross Production Tax rate of oil shall be as follows:

• If the average price of Oklahoma oil equals or exceeds Seventeen Dollars ($17.00) per barrel, the tax shall be Seven Percent (7%).

• If the average price of Oklahoma oil is less than Seventeen Dollars ($17.00) but is equal to or exceeds Fourteen Dollars ($14.00) per barrel, then the tax

shall be Four Percent (4%).

• If the average price of Oklahoma oil is less than Fourteen Dollars ($14.00) per barrel, then the tax shall be One Percent (1%).

The Gross Production Tax rate of gas shall be as follows:

• If the average price of Oklahoma gas equals or exceeds Two Dollars and Ten Cents ($2.10) per mcf, the tax shall be Seven Percent (7%).

• If the average price of Oklahoma gas is less than Two Dollars and Ten Cents ($2.10) but is equal to or exceeds One Dollar and Seventy-Five Cents

($1.75) per mcf, then the tax shall be Four Percent (4%).

• If the average price of Oklahoma gas is less than One Dollar and Seventy-Five Cents ($1.75) per mcf, then the tax shall be One Percent (1%).

Reduced Gross Production Tax rate of oil or gas due to Incentive Qualification as listed in Block 16:

• If the incentive identified in Block 16 is 006 Horizontal Well, then the tax shall be One Percent (1%).

• If the incentive identified in Block 16 is 008 or 009 for Ultra Deep Well, then the tax shall be Four Percent (4%).

30. Petroleum Excise Tax due on oil or gas for each entry. (.00095 times the Taxable Value)

31. Total Gross Volume of all entries (Block 12) shown on this page.

32. Total Gross Value of all entries (Block 13) shown on this page.

33. Total amount of Additional Value (Block 21) shown on this page.

34. Total of all Tax Reimbursement (Block 22) shown on this page.

35. Total Exempt Volume of all entries (Block 25) shown on this page.

36. Total Exempt Value of all entries (Block 26) shown on this page.

37. Total Taxable Volume of all entries (Block 27) shown on this page.

38. Total Taxable Value of all entries (Block 28) shown on this page.

39. Total Gross Production Tax due on all entries (Block 29) shown on this page.

40. Total Petroleum Excise Tax due on all entries (Block 30) shown on this page.

41. — 50. County totals for each block - for each production month and product code. Total all entries in county (only last page for each county).

OTC Form GPX0004 (300-A) and OTC Form 300-B (County Summary) must accompany this report. All remittances must be accompanied by GPX0004 (300-C).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2