Denver Telecommunications Business Tax Return Monthly Form - City And County Of Denver

ADVERTISEMENT

City and County of Denver

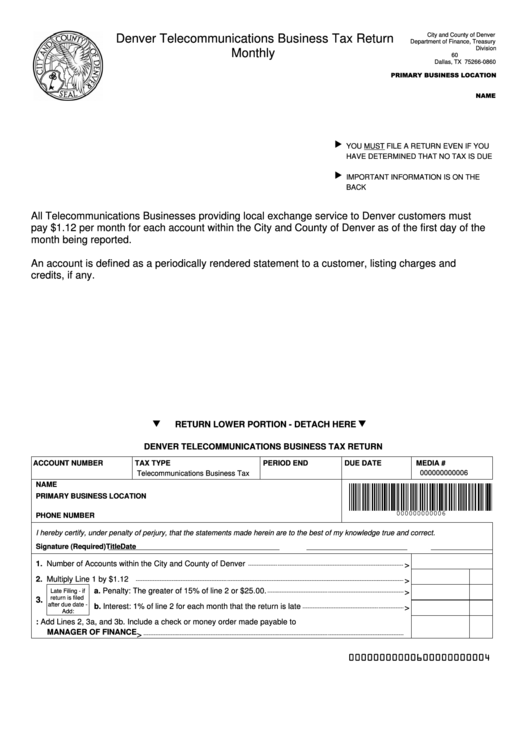

Denver Telecommunications Business Tax Return

Department of Finance, Treasury

Division

Monthly

P.O. Box 660860

Dallas, TX 75266-0860

PRIMARY BUSINESS LOCATION

NAME

u

YOU MUST FILE A RETURN EVEN IF YOU

HAVE DETERMINED THAT NO TAX IS DUE

u

IMPORTANT INFORMATION IS ON THE

BACK

All Telecommunications Businesses providing local exchange service to Denver customers must

pay $1.12 per month for each account within the City and County of Denver as of the first day of the

month being reported.

An account is defined as a periodically rendered statement to a customer, listing charges and

credits, if any.

q

q

RETURN LOWER PORTION - DETACH HERE

DENVER TELECOMMUNICATIONS BUSINESS TAX RETURN

MEDIA #

ACCOUNT NUMBER

TAX TYPE

PERIOD END

DUE DATE

000000000006

Telecommunications Business Tax

NAME

PRIMARY BUSINESS LOCATION

000000000006

PHONE NUMBER

I hereby certify, under penalty of perjury, that the statements made herein are to the best of my knowledge true and correct.

Signature (Required)

Title

Date

1. Number of Accounts within the City and County of Denver

>

2. Multiply Line 1 by $1.12

>

a. Penalty: The greater of 15% of line 2 or $25.00.

Late Filing - if

>

return is filed

3.

after due date -

b. Interest: 1% of line 2 for each month that the return is late

>

Add:

4. TOTAL DUE AND PAYABLE: Add Lines 2, 3a, and 3b. Include a check or money order made payable to

MANAGER OF FINANCE

>

00000000000600000000004

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1