2368, Page 2

Instructions for Form 2368

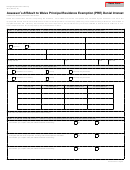

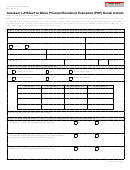

Principal Residence Exemption (PRE) Affidavit

If you own and occupy your principal residence, it may be exempt from a portion of your local school operating taxes. To claim an

exemption, complete this Affidavit and file it with your township or city by May 1 of the year of the claim. Your local assessor will adjust

your taxes on your next property tax bill. Note that this is an exemption from part of the taxes and does not affect your assessment.

Principal residence means the dwelling that you occupy as your permanent home and any unoccupied adjacent or contiguous properties

that are classified residential.

Owning means you hold the legal title to the principal residence or that you are currently buying it on a notarized or recorded land

contract. Renters should not file this form.

Occupying means this is your principal residence, the place you intend to return to whenever you go away. It may be the address that

appears on your driver's license or voter registration card. Vacation homes and income property that you do not occupy as your

principal residence may not be claimed. You may have only one principal residence at a time, however, you can file a Conditional

Rescission of Principal Residence Exemption (PRE) (Form 4640) on unsold property that is your previous principal residence under the

following conditions: it is for sale, is not occupied, is not leased, and is not used for any business or commercial purpose.

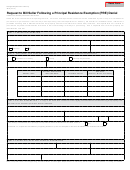

RESCINdING YOUR ExEMPTION

If you claim an exemption and then stop using it as a principal residence, you must notify your township or city assessor within 90 days of

the change or you may be penalized. This can be done using the Request to Rescind Principal Residence Exemption (PRE) (Form 2602)

or filing Form 4640, as noted above.

INTEREST ANd PENALTY

If it is determined that you claimed property that is not your principal residence, you may be subject to the additional tax plus penalty

and interest as determined under the General Property Tax Act.

PART 1: PROPERTY INFORMATION

Submit a separate affidavit for each property tax identification number being claimed.

It is imporatant that your property tax identification number is entered accurately. This ensures that your property is identified

properly and that your township or city can accurately adjust your property taxes. You can find this number on your tax bill and on your

property tax assessment notice. If you cannot find this number, call your township or city assessor.

NOTE: Do not include information for a co-owner who does not occupy the property as a principal residence.

The request for the Social Security number is authorized under Section 42 USC 405 (c) (2) (C) (i). It is used by the Department of

Treasury to verify tax exemption claims and to deter fraudulent filings. Any use of the number by closing agents or local units of

government is illegal and subject to penalty.

Line 3: If you own and live in a multi-unit or multi-purpose property (e.g., a duplex or apartment building, or a storefront with an

upstairs flat), you can claim an exemption only for the portion that you use as your principal residence. Calculate your portion by dividing

the floor area of your principal residence by the floor area of the entire building.

If the parcel of property you are claiming has more than one home on it, you must determine the percentage that you own and occupy

as your principal residence. A second residence on the same property (e.g., a mobile home or second house) is not part of your principal

residence, even if it is not rented to another person. Your local assessor can tell you the assessed value of each residence to help you

determine the percentage that is your principal residence.

If you rent part of your home to another person, you may have to prorate your exemption. If your home is a single-family dwelling

and the renters enter through a common door or your living area to get to their rooms, you may claim a 100 percent exemption if less

than 50 percent of your home is rented to others who use it as a residence. However, if part of the home was converted to an apartment

with a separate entrance, you must calculate the percentage that is your principal residence by dividing the floor area of your principal

residence by the floor area of the entire building.

PART 2: CERTIFICATION

Sign and date the form. Enter your mailing address if it is different from the address under Part 1.

MAILING INFORMATION

Mail your completed form to the township or city assessor where the property is located. This address may be on your most recent tax

bill or assessment notice. Do NoT send this form directly to the Department of Treasury.

If you have any questions, visit our Web site at or call (517) 373-1950.

1

1 2

2