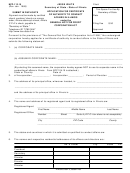

Form Lm-Reap-Seb - Application For Certificate Of Eligibility - 2008 Page 3

ADVERTISEMENT

LM-REAP-SEB - Lower Manhattan Relocation and Employment Assistance Program Benefits for Special Eligible Businesses

Page 3

SECTION C: RELOCATION SITE INFORMATION - Continued

(2) Premises are wholly contained or situated on real property that has been

leased from the New York City Industrial Development Agency?......................................

YES

NO

K

K

If “YES”, submit a copy of the lease.

(3) Premises are wholly contained in or situated on real property that is owned

by the City of New York? ...................................................................................................

YES

NO

K

K

If “YES”, submit a copy of the lease.

(4) Premises are wholly contained or situated on real property that is owned

by the Port Authority or the New York State Urban Development Corporation

or a subsidiary thereof? .....................................................................................................

YES

NO

K

K

If “YES”, submit a copy of the lease.

(5) Premises are wholly contained in or situated on real property that would be

eligible to receive benefits pursuant to the Cityʼs ICAP Program, except that such

property is exempt from real property taxation? ................................................................

YES

NO

K

K

If “YES”, submit a copy of the lease and the ICAP Preliminary Certificate of Eligibility.

4. b. Were the premises to which you relocated improved by construction or

renovation? .............................................................................................................................

YES

NO

K

K

(1) Answer this question only if you checked Question 4a (2):

Was such construction or renovation made with the approval of the NYC

Industrial Development Agency? .......................................................................................

YES

NO

K

K

(2) Answer this question only if you checked Question 4a (3):

Was such construction or renovation made with the approval of your lease in

accordance with the NYC Charter? ...................................................................................

YES

NO

K

K

(3) On or after July 1, 2005, have there been expenditures made in excess of 50%

of the propertyʼs assessed value (or, in the case of industrial property, in excess

of 25%) for improvements to the real property in which your premises are located? .....

YES

NO

K

K

(4) Were such expenditures made within 36 months, or, if the expenditures were in

excess of $50 million, were they made within 72 months from commencement of

the lease? ..........................................................................................................................

YES

NO

K

K

IF YOU ANSWER “YES” TO ANY QUESTION IN 4b, YOU MUST SUBMIT COPIES

OF INVOICES AND CANCELED CHECKS TO DOCUMENT EXPENDITURES.

ATTACH A RIDER.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5