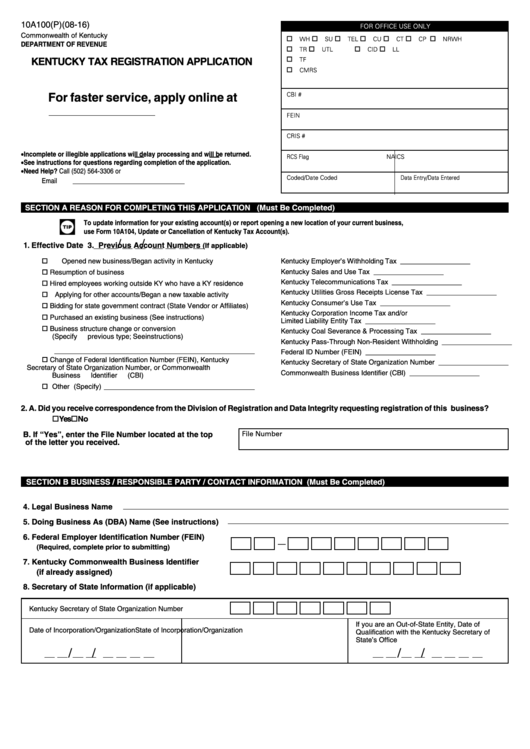

10A100(P)(08-16)

FOR OFFICE USE ONLY

Commonwealth of Kentucky

WH

SU

TEL

CU

CT

CP

NRWH

DEPARTMENT OF REVENUE

TR

UTL

CID

LL

KENTUCKY TAX REGISTRATION APPLICATION

TF

CMRS

For faster service, apply online at

CBI #

FEIN

CRIS #

•

Incomplete or illegible applications will delay processing and will be returned.

RCS Flag

NAICS

•

See instructions for questions regarding completion of the application.

•

Need Help?

Call (502) 564-3306 or

Coded/Date Coded

Data Entry/Data Entered

Email

DOR.WEBResponseRegistration@ky.gov

SECTION A

REASON FOR COMPLETING THIS APPLICATION

(Must Be Completed)

To update information for your existing account(s) or report opening a new location of your current business,

use Form 10A104, Update or Cancellation of Kentucky Tax Account(s).

/

/

1. Effective Date

3. Previous Account Numbers

(If applicable)

Opened new business/Began activity in Kentucky

Kentucky Employer’s Withholding Tax

__________________

Kentucky Sales and Use Tax

__________________

Resumption of business

Kentucky Telecommunications Tax

__________________

Hired employees working outside KY who have a KY residence

Kentucky Utilities Gross Receipts License Tax

__________________

Applying for other accounts/Began a new taxable activity

Kentucky Consumer’s Use Tax

__________________

Bidding for state government contract (State Vendor or Affiliates)

Kentucky Corporation Income Tax and/or

Purchased an existing business (See instructions)

Limited Liability Entity Tax

__________________

Business structure change or conversion

Kentucky Coal Severance & Processing Tax

__________________

(Specify previous type; See instructions)

Kentucky Pass-Through Non-Resident Withholding __________________

Federal ID Number (FEIN)

__________________

Change of Federal Identification Number (FEIN), Kentucky

Kentucky Secretary of State Organization Number __________________

Secretary of State Organization Number, or Commonwealth

Commonwealth Business Identifier (CBI)

__________________

Business Identifier (CBI)

Other (Specify)

2.

A. Did you receive correspondence from the Division of Registration and Data Integrity requesting registration of this business?

Yes

No

B. If “Yes”, enter the File Number located at the top

File Number

of the letter you received.

SECTION B

BUSINESS / RESPONSIBLE PARTY / CONTACT INFORMATION

(Must Be Completed)

4. Legal Business Name

5. Doing Business As (DBA) Name (See instructions)

6. Federal Employer Identification Number (FEIN)

—

(Required, complete prior to submitting)

7. Kentucky Commonwealth Business Identifier

(if already assigned)

8. Secretary of State Information (if applicable)

Kentucky Secretary of State Organization Number

If you are an Out-of-State Entity, Date of

Date of Incorporation/Organization

State of Incorporation/Organization

Qualification with the Kentucky Secretary of

State’s Office

/

/

/

/

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9