Instructions for Admissions Tax Return

General Instructions

The vast majority of allowable deductions are

covered by lines 2A and 2B. Taxpayers are

Purpose of Form

encouraged to contact the Sales Tax Division

prior to taking any other deductions to avoid

This form is used for taxpayers to report sales of

improperly deducting taxable sales.

admissions and related tax liabilities pursuant to Chapter 3

of Title IV of the Westminster Municipal Code (“Code”).

Total Deductions. Add the amounts listed on lines 2A

This form should not be used to report liabilities for other

through 2C and enter the total on this line.

tax types, such as sales or use taxes.

Line 3 – Net Taxable Admissions. Subtract line 2 from

Due Date

line 1 and enter the difference on this line 3.

th

Admissions tax returns must be filed on or before the 20

Line 4 – Amount of Admissions Tax. Multiply the amount

of the month following the end of a reporting period, even if

computed on line 3 by the applicable admissions tax rate

no tax is due. Generally, sellers of admissions will be

listed on this line 4. Enter the total on this line.

required to file on a monthly basis. Returns filed by mail

must be postmarked by the due date. Refer to the face of

Line 5 – Excess Tax. Sellers are not permitted to retain

the return for the reporting period and due date.

any amounts collected in excess of the amount computed

on line 4. If the total Westminster admissions tax collected

Reminders

exceeds the amount computed on line 4, enter the

difference on this line 5.

Additional returns may be required. Sellers of taxable

admissions must also file periodic sales and use tax returns

Line 6 – Admissions Tax Due. Add line 5 to line 4 and

and may also be required to file additional returns for other

enter the total on this line 6.

tax types. Contact the Sales Tax Division for additional

information.

Line 7 – Late Filing Charges. If the tax will be reported or

paid after the due date, compute and add penalty and

Verify the reporting period and due date. Please check

interest as follows:

the return form to ensure you are using the return which

corresponds with the reporting period for which you are

A) Penalty – Multiply the amount on line 6 by 10%

filing. If you have misplaced the required return, you may

and enter the greater of this amount or $15.

obtain a blank return on the City website or contact the

Sales Tax Division for a replacement.

B) Interest - Interest accrues only in whole-month

increments from the due date. Multiply the amount

listed on line 6 by 1% and multiply this result by

Do not attach enclosures. Mail the completed and signed

return in the envelope provided. Do not staple the check or

the number of months the tax remained unpaid.

other attachments to the return.

Total Penalty and Interest. Add lines 7A and 7B and enter

the total on this line.

Signature required. The person completing the return on

behalf of the taxpayer must sign and date the form at the

bottom. A printed name is also required. If the taxpayer is

Line 8 – Amount Due. Add line 7 to line 6 and enter the

not a natural person, the title of the officer or agent

total on this line 8. This is the total due. Make your check

completing the form on behalf of the taxpayer must also be

payable for this amount to the City of Westminster.

printed on the form. Forms without a signature may be

returned and may not be considered timely filed.

Signature – After reviewing the form for accuracy, sign and

date the form. Print your name and title below your

signature.

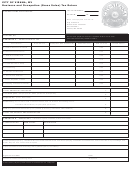

Specific Instructions

City of Westminster

Line 1 – Gross Sales of Admissions. Enter the total

Department of Finance

amount of receipts from sales of admissions, both taxable

Sales Tax Division

and non-taxable, for the reporting period covered.

Phone: (303) 658-2065

Fax: (303) 706-3923

Line 2 – Deductions. Enter the amounts, if any, of exempt

sales as follows:

A) Enter the total amount of sales billed directly to

CITY USE ONLY (LOCKBOX VALIDATION)

and paid directly by the funds of qualifying

government and charitable organizations. See Tax

Compliance

Guide

topic

307

for

additional

information.

B) Enter the amount of admissions tax, if any,

included in the amounts reported on line 1

because it was included in the price of admissions.

C) Enter other exempt sales not covered above.

1

1 2

2