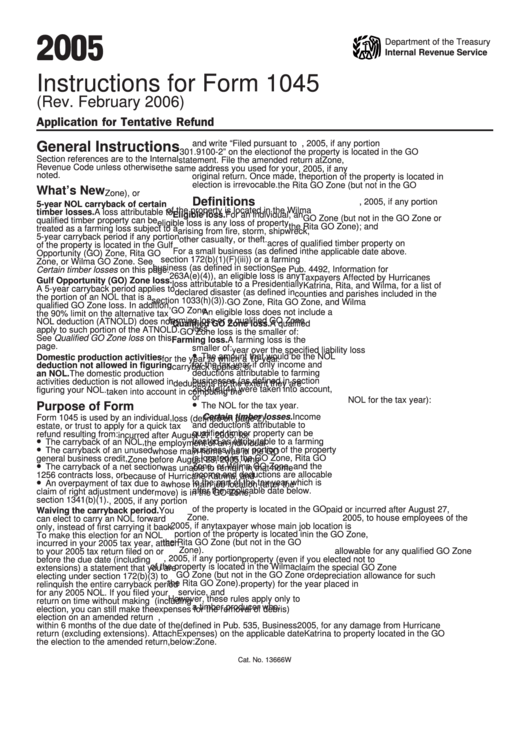

Instructions For Form 1045 (Rev. February 2006) - 2005

ADVERTISEMENT

05

2 0

Department of the Treasury

Internal Revenue Service

Instructions for Form 1045

(Rev. February 2006)

Application for Tentative Refund

and write “Filed pursuant to section

a. August 28, 2005, if any portion

General Instructions

301.9100-2” on the election

of the property is located in the GO

Section references are to the Internal

statement. File the amended return at

Zone,

Revenue Code unless otherwise

the same address you used for your

b. September 23, 2005, if any

noted.

original return. Once made, the

portion of the property is located in

election is irrevocable.

the Rita GO Zone (but not in the GO

What’s New

Zone), or

Definitions

c. October 23, 2005, if any portion

5-year NOL carryback of certain

of the property is located in the Wilma

timber losses. A loss attributable to

Eligible loss. For an individual, an

GO Zone (but not in the GO Zone or

qualified timber property can be

eligible loss is any loss of property

the Rita GO Zone); and

treated as a farming loss subject to a

arising from fire, storm, shipwreck,

2. Did not hold more than 500

5-year carryback period if any portion

other casualty, or theft.

acres of qualified timber property on

of the property is located in the Gulf

For a small business (as defined in

the applicable date above.

Opportunity (GO) Zone, Rita GO

section 172(b)(1)(F)(iii)) or a farming

Zone, or Wilma GO Zone. See

business (as defined in section

Certain timber losses on this page.

See Pub. 4492, Information for

263A(e)(4)), an eligible loss is any

Taxpayers Affected by Hurricanes

Gulf Opportunity (GO) Zone loss.

loss attributable to a Presidentially

Katrina, Rita, and Wilma, for a list of

A 5-year carryback period applies to

declared disaster (as defined in

counties and parishes included in the

the portion of an NOL that is a

section 1033(h)(3)).

GO Zone, Rita GO Zone, and Wilma

qualified GO Zone loss. In addition,

GO Zone.

An eligible loss does not include a

the 90% limit on the alternative tax

farming loss or a qualified GO Zone

NOL deduction (ATNOLD) does not

Qualified GO Zone loss. A qualified

loss.

apply to such portion of the ATNOLD.

GO Zone loss is the smaller of:

See Qualified GO Zone loss on this

Farming loss. A farming loss is the

1. The excess of the NOL for the

page.

smaller of:

year over the specified liability loss

•

The amount that would be the NOL

Domestic production activities

for the year to which a 10-year

for the tax year if only income and

deduction not allowed in figuring

carryback applies, or

deductions attributable to farming

an NOL. The domestic production

2. The total of the following

businesses (as defined in section

activities deduction is not allowed in

deductions (to the extent they are

263A(e)(4)) were taken into account,

figuring your NOL.

taken into account in computing the

or

NOL for the tax year):

•

Purpose of Form

The NOL for the tax year.

a. Qualified GO Zone casualty

Certain timber losses. Income

Form 1045 is used by an individual,

loss (defined on page 2),

and deductions attributable to

estate, or trust to apply for a quick tax

b. Moving expenses paid or

qualified timber property can be

refund resulting from:

incurred after August 27, 2005, for

•

treated as attributable to a farming

The carryback of an NOL,

the employment of an individual

•

business if any portion of the property

The carryback of an unused

whose main home was in the GO

is located in the GO Zone, Rita GO

general business credit,

Zone before August 28, 2005, who

•

Zone, or Wilma GO Zone, and the

The carryback of a net section

was unable to remain in that home

income and deductions are allocable

1256 contracts loss, or

because of Hurricane Katrina, and

•

to the part of the tax year which is

An overpayment of tax due to a

whose main job location (after the

after the applicable date below.

claim of right adjustment under

move) is in the GO Zone,

section 1341(b)(1).

1. August 27, 2005, if any portion

c. Temporary housing expenses

of the property is located in the GO

paid or incurred after August 27,

Waiving the carryback period. You

Zone.

2005, to house employees of the

can elect to carry an NOL forward

2. September 22, 2005, if any

taxpayer whose main job location is

only, instead of first carrying it back.

portion of the property is located in

in the GO Zone,

To make this election for an NOL

the Rita GO Zone (but not in the GO

d. Depreciation or amortization

incurred in your 2005 tax year, attach

Zone).

allowable for any qualified GO Zone

to your 2005 tax return filed on or

3. October 22, 2005, if any portion

property (even if you elected not to

before the due date (including

of the property is located in the Wilma

claim the special GO Zone

extensions) a statement that you are

GO Zone (but not in the GO Zone or

depreciation allowance for such

electing under section 172(b)(3) to

the Rita GO Zone).

property) for the year placed in

relinquish the entire carryback period

for any 2005 NOL. If you filed your

service, and

However, these rules apply only to

return on time without making the

e. Repair expenses (including

a timber producer who:

election, you can still make the

expenses for the removal of debris)

election on an amended return filed

1. Held qualified timber property

paid or incurred after August 27,

within 6 months of the due date of the

(defined in Pub. 535, Business

2005, for any damage from Hurricane

return (excluding extensions). Attach

Expenses) on the applicable date

Katrina to property located in the GO

the election to the amended return,

below:

Zone.

Cat. No. 13666W

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8