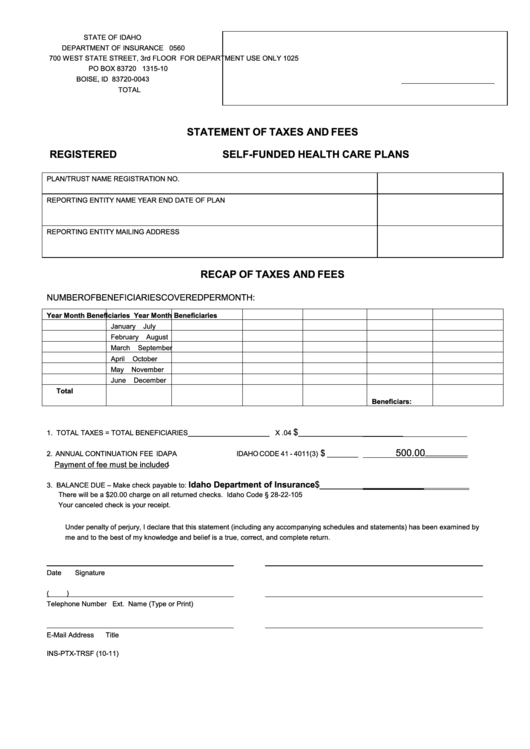

Statement Of Taxes And Fees Registered Self-Funded Health Care Plans - Idaho Department Of Insurance

ADVERTISEMENT

STATE OF IDAHO

DEPARTMENT OF INSURANCE

0560

700 WEST STATE STREET, 3rd FLOOR

FOR DEPARTMENT USE ONLY

1025

PO BOX 83720

1315-10

BOISE, ID 83720-0043

TOTAL

STATEMENT OF TAXES AND FEES

REGISTERED SELF-FUNDED HEALTH CARE PLANS

PLAN/TRUST NAME

REGISTRATION NO.

REPORTING ENTITY NAME

YEAR END DATE OF PLAN

REPORTING ENTITY MAILING ADDRESS

RECAP OF TAXES AND FEES

NUMBER OF BENEFICIARIES COVERED PER MONTH:

Year

Month

Beneficiaries

Year

Month

Beneficiaries

January

July

February

August

March

September

April

October

May

November

June

December

Total

Beneficiars:

$

1. TOTAL TAXES = TOTAL BENEFICIARIES_____________________ X .04

___________________________

500.00

$

2. ANNUAL CONTINUATION FEE IDAPA 18.01.44.03.a.viii. IDAHO CODE 41 - 4011(3)

________

___________

Payment of fee must be included

.

$______________________

Idaho Department of Insurance

3. BALANCE DUE – Make check payable to:

There will be a $20.00 charge on all returned checks. Idaho Code § 28-22-105

Your canceled check is your receipt.

Under penalty of perjury, I declare that this statement (including any accompanying schedules and statements) has been examined by

me and to the best of my knowledge and belief is a true, correct, and complete return.

Date

Signature

(

)

Telephone Number

Ext.

Name (Type or Print)

E-Mail Address

Title

INS-PTX-TRSF (10-11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1