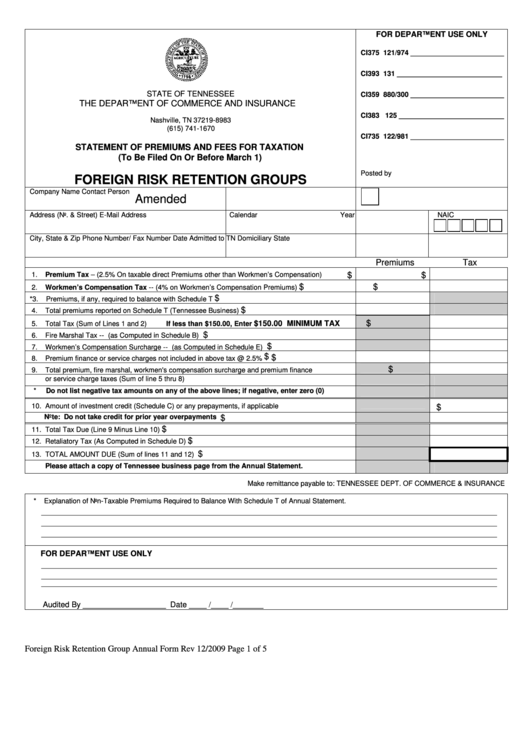

Statement Of Premiums And Fees For Taxation (To Be Filed On Or Before March 1) Foreign Risk Retention Groups

ADVERTISEMENT

FOR DEPARTMENT USE ONLY

CI375 121/974 ________________________

CI393 131 ___________________________

STATE OF TENNESSEE

CI359 880/300 ________________________

THE DEPARTMENT OF COMMERCE AND INSURANCE

P.O. BOX 198983

CI383 125 ___________________________

Nashville, TN 37219-8983

(615) 741-1670

CI735 122/981 ________________________

STATEMENT OF PREMIUMS AND FEES FOR TAXATION

(To Be Filed On Or Before March 1)

Posted by

FOREIGN RISK RETENTION GROUPS

Company Name

Contact Person

Amended

Address (No. & Street)

E-Mail Address

Calendar Year

NAIC CO.CODE

City, State & Zip

Phone Number/ Fax Number

Date Admitted to TN

Domiciliary State

Premiums

Tax

1.

Premium Tax – (2.5% On taxable direct Premiums other than Workmen’s Compensation)

$

$

$

$

2.

Workmen’s Compensation Tax -- (4% on Workmen’s Compensation Premiums)

$

*3.

Premiums, if any, required to balance with Schedule T

$

4.

Total premiums reported on Schedule T (Tennessee Business)

$

$150.00 MINIMUM TAX

5.

Total Tax (Sum of Lines 1 and 2)

If less than $150.00, Enter

$

6.

Fire Marshal Tax -- (as Computed in Schedule B)

$

7.

Workmen’s Compensation Surcharge -- (as Computed in Schedule E)

$

$

8.

Premium finance or service charges not included in above tax @ 2.5%

$

9.

Total premium, fire marshal, workmen's compensation surcharge and premium finance

or service charge taxes (Sum of line 5 thru 8)

*

Do not list negative tax amounts on any of the above lines; if negative, enter zero (0)

10. Amount of investment credit (Schedule C) or any prepayments, if applicable

$

Note: Do not take credit for prior year overpayments

$

$

11. Total Tax Due (Line 9 Minus Line 10)

$

12. Retaliatory Tax (As Computed in Schedule D)

$

13. TOTAL AMOUNT DUE (Sum of lines 11 and 12)

Please attach a copy of Tennessee business page from the Annual Statement.

Make remittance payable to: TENNESSEE DEPT. OF COMMERCE & INSURANCE

*

Explanation of Non-Taxable Premiums Required to Balance With Schedule T of Annual Statement.

_____________________________________________________________________________________________________________________

_____________________________________________________________________________________________________________________

_____________________________________________________________________________________________________________________

FOR DEPARTMENT USE ONLY

_____________________________________________________________________________________________________________________

_____________________________________________________________________________________________________________________

_____________________________________________________________________________________________________________________

Audited By ___________________ Date ____ /____ /_______

Foreign Risk Retention Group Annual Form Rev 12/2009

Page 1 of 5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4