Form 700 - Partnership Income Tax Return Instructions - Department Of Revenue - Georgia

ADVERTISEMENT

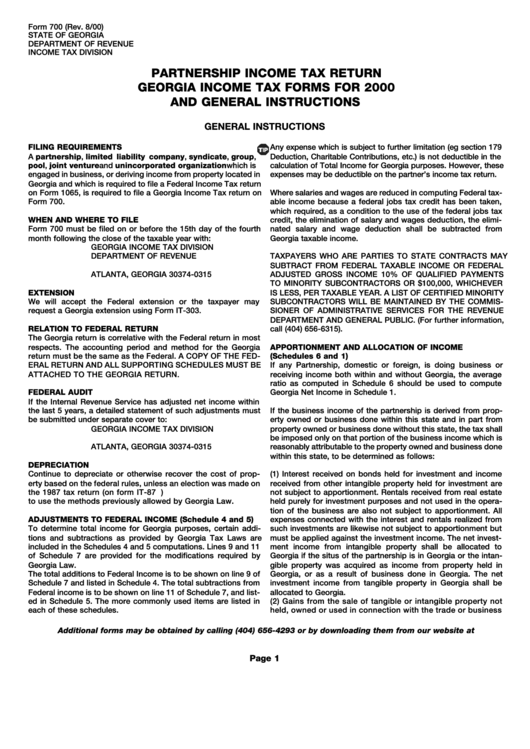

Form 700 (Rev. 8/00)

STATE OF GEORGIA

DEPARTMENT OF REVENUE

INCOME TAX DIVISION

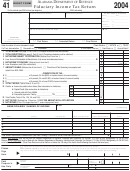

PARTNERSHIP INCOME TAX RETURN

GEORGIA INCOME TAX FORMS FOR 2000

AND GENERAL INSTRUCTIONS

GENERAL INSTRUCTIONS

FILING REQUIREMENTS

Any expense which is subject to further limitation (eg section 179

A partnership, limited liability company, syndicate, group,

Deduction, Charitable Contributions, etc.) is not deductible in the

pool, joint venture and unincorporated organization which is

calculation of Total Income for Georgia purposes. However, these

engaged in business, or deriving income from property located in

expenses may be deductible on the partner’s income tax return.

Georgia and which is required to file a Federal Income Tax return

on Form 1065, is required to file a Georgia Income Tax return on

Where salaries and wages are reduced in computing Federal tax-

Form 700.

able income because a federal jobs tax credit has been taken,

which required, as a condition to the use of the federal jobs tax

WHEN AND WHERE TO FILE

credit, the elimination of salary and wages deduction, the elimi-

Form 700 must be filed on or before the 15th day of the fourth

nated salary and wage deduction shall be subtracted from

month following the close of the taxable year with:

Georgia taxable income.

GEORGIA INCOME TAX DIVISION

DEPARTMENT OF REVENUE

TAXPAYERS WHO ARE PARTIES TO STATE CONTRACTS MAY

P.O. BOX 740315

SUBTRACT FROM FEDERAL TAXABLE INCOME OR FEDERAL

ATLANTA, GEORGIA 30374-0315

ADJUSTED GROSS INCOME 10% OF QUALIFIED PAYMENTS

TO MINORITY SUBCONTRACTORS OR $100,000, WHICHEVER

EXTENSION

IS LESS, PER TAXABLE YEAR. A LIST OF CERTIFIED MINORITY

We will accept the Federal extension or the taxpayer may

SUBCONTRACTORS WILL BE MAINTAINED BY THE COMMIS-

request a Georgia extension using Form IT-303.

SIONER OF ADMINISTRATIVE SERVICES FOR THE REVENUE

DEPARTMENT AND GENERAL PUBLIC. (For further information,

RELATION TO FEDERAL RETURN

call (404) 656-6315).

The Georgia return is correlative with the Federal return in most

respects. The accounting period and method for the Georgia

APPORTIONMENT AND ALLOCATION OF INCOME

return must be the same as the Federal. A COPY OF THE FED-

(Schedules 6 and 1)

ERAL RETURN AND ALL SUPPORTING SCHEDULES MUST BE

If any Partnership, domestic or foreign, is doing business or

ATTACHED TO THE GEORGIA RETURN.

receiving income both within and without Georgia, the average

ratio as computed in Schedule 6 should be used to compute

FEDERAL AUDIT

Georgia Net Income in Schedule 1.

If the Internal Revenue Service has adjusted net income within

the last 5 years, a detailed statement of such adjustments must

If the business income of the partnership is derived from prop-

be submitted under separate cover to:

erty owned or business done within this state and in part from

GEORGIA INCOME TAX DIVISION

property owned or business done without this state, the tax shall

P.O. BOX 740315

be imposed only on that portion of the business income which is

ATLANTA, GEORGIA 30374-0315

reasonably attributable to the property owned and business done

within this state, to be determined as follows:

DEPRECIATION

Continue to depreciate or otherwise recover the cost of prop-

(1) Interest received on bonds held for investment and income

erty based on the federal rules, unless an election was made on

received from other intangible property held for investment are

the 1987 tax return (on form IT-87 D.E. or a written statement)

not subject to apportionment. Rentals received from real estate

to use the methods previously allowed by Georgia Law.

held purely for investment purposes and not used in the opera-

tion of the business are also not subject to apportionment. All

ADJUSTMENTS TO FEDERAL INCOME (Schedule 4 and 5)

expenses connected with the interest and rentals realized from

To determine total income for Georgia purposes, certain addi-

such investments are likewise not subject to apportionment but

tions and subtractions as provided by Georgia Tax Laws are

must be applied against the investment income. The net invest-

included in the Schedules 4 and 5 computations. Lines 9 and 11

ment income from intangible property shall be allocated to

of Schedule 7 are provided for the modifications required by

Georgia if the situs of the partnership is in Georgia or the intan-

Georgia Law.

gible property was acquired as income from property held in

The total additions to Federal Income is to be shown on line 9 of

Georgia, or as a result of business done in Georgia. The net

Schedule 7 and listed in Schedule 4. The total subtractions from

investment income from tangible property in Georgia shall be

Federal income is to be shown on line 11 of Schedule 7, and list-

allocated to Georgia.

ed in Schedule 5. The more commonly used items are listed in

(2) Gains from the sale of tangible or intangible property not

each of these schedules.

held, owned or used in connection with the trade or business

Additional forms may be obtained by calling (404) 656-4293 or by downloading them from our website at

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2