Form Ct-5.4 - Instructions - Nys Corporation Tax - 1998

ADVERTISEMENT

CT-5.4 (1998) (back)

Instructions

(continued)

Who May File Form CT-5.4

Line A - Make your payment in United States funds. A foreign check

or foreign money order will only be accepted if payable through a

A general business corporation (Article 9-A) or banking corporation

United States Bank or if marked Payable in U.S. Funds.

(Article 32) that has elected to be a New York S corporation by filing

Form CT-6 may file Form CT-5.4 to request one six-month extension of

Line 1 - To determine the properly estimated tax, enter the amount

time to file Form CT-3-S, Form CT-4-S, or Form CT-32-S. Additional

determined under (a) or (b) below. However, if your S corporation was

extensions of time (beyond 6 months) will not be granted to New York

not subject to tax for the preceding tax year, or if the preceding tax

S corporations.

year was less than 12 months, skip (a) and use the amount

A group of S corporations filing on a combined basis on

determined under (b).

Form CT-3-S-A may not use Form CT-5.4 to request an extension. To

request an extension to file Form CT-3-S-A, New York S Corporation

(a) 100% of the franchise tax (computed after the deduction of any

special additional mortgage recording tax credit) shown on your

Combined Franchise Tax Return, use Form CT-5.3, Request for

Six-Month Extension to File (Combined Franchise Tax Return, MTA

franchise tax return for the preceding year if it was a tax year of 12

Surcharge Return, or Both).

months. Do not include any tax amount of a qualified subchapter S

subsidiary (QSSS) that previously filed a separate franchise tax

When and Where to File

return.

File Form CT-5.4 on or before the due date of your tax return (2

⁄

1

2

(b) Determine the estimated franchise tax (computed after the

months following the end of the tax year).

deduction of any special additional mortgage recording tax credit)

Mail Form CT-5.4 to:

for the tax year for which this extension is requested. If you are the

NYS CORPORATION TAX

parent of a QSSS, include all items of income, deduction, and

PROCESSING UNIT

other economic activity related to the QSSS. Multiply the estimated

PO BOX 22109

franchise tax by an amount not less than 90%.

ALBANY NY 12201-2109

Line 2 - If the total franchise tax on line 1 exceeds $1,000, you must

Private Delivery Services

pay a first installment of estimated tax for the next tax year. Multiply

The date recorded or marked by certain private delivery services, as

the amount on line 1 by 25% and enter the result on line 2.

designated by the U.S. Secretary of the Treasury or the Commissioner

of Taxation and Finance, will be treated as a postmark, and that date

If you are not required to pay the first installment of estimated tax for

will be considered to be the date of delivery in determining whether

the next tax year, enter ‘‘0’’ on line 2.

your return was filed on time. (Designated delivery services are listed

in Publication 55, Designated Private Delivery Services . See Need

Need Help?

Help? below for information on ordering forms and publications.) If you

Telephone Assistance is available from 8:30 a.m. to 4:25 p.m.

use any private delivery service, address your return to: State

(eastern time), Monday through Friday. For business tax information

Processing Center, 431C Broadway, Menands, NY 12204.

and forms, call the Business Tax Information Center at

1 800 972-1233. For general information, call toll free

Employer Identification Number, File Number and Other

1 800 225-5829. To order forms and publications, call toll free

Identifying Information

1 800 462-8100. From areas outside the U.S. and outside Canada,

To assist us in processing your corporation tax forms as quickly and

call (518) 485-6800.

efficiently as possible, it is important that we have the necessary

identifying information from your preprinted label. Keep a record of

Fax-on-Demand Forms Ordering System - Most forms are available

by fax 24 hours a day, 7 days a week. Call toll free from the U.S. and

the label information for future use. Please be certain to include

Canada 1 800 748-3676. You must use a Touch Tone phone to order by

your employer identification number and file number on each

fax. A fax code is used to identify each form.

corporation tax form mailed. This will facilitate processing of your

return to the correct account. Without this information, we may not be

Internet Access -

able to process your return.

Access our website for forms, publications, and information.

If you use a paid preparer or accounting firm, make sure they use the

Hotline for the Hearing and Speech Impaired - If you have access to

mailing label or label information when completing all forms prepared

a telecommunications device for the deaf (TDD), you can get answers

for you.

to your New York State tax questions by calling toll free from the U.S.

and Canada 1 800 634-2110. Assistance is available from 8:30 a.m. to

Line Instructions

4:15 p.m. (eastern time), Monday through Friday. If you do not own a

Reporting Period

TDD, check with independent living centers or community action

programs to find out where machines are available for public use.

If you are a calendar year filer, check the box in the upper right corner

on the front of the form. If you are a fiscal year filer, complete the

Persons with Disabilities - In compliance with the Americans with

beginning and ending tax period boxes in the upper right corner on

Disabilities Act, we will ensure that our lobbies, offices, meeting rooms,

the front of the form.

and other facilities are accessible to persons with disabilities. If you

have questions about special accommodations for persons with

Business Activity Code Number - Enter the business activity code

disabilities, please call the information numbers listed above.

number from your federal return. Please check the appropriate box for

the type of code you are using. Check the box marked NAICS if you

Mailing Address - If you need to write, address your letter to: NYS Tax

use the North American Industry Classification System. If you have

Department, Taxpayer Assistance Bureau, W A Harriman Campus,

entered a Principal Industrial Activity (PIA) or Standard Industrial

Albany NY 12227.

Classification (SIC) code, check the box marked Other.

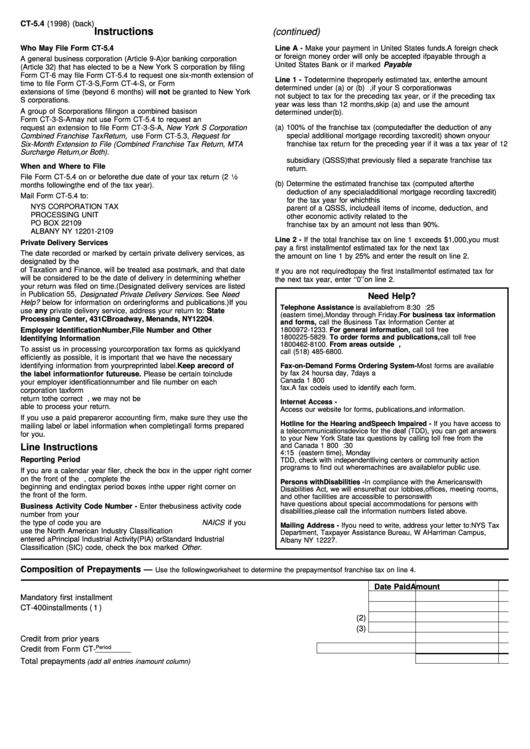

Composition of Prepayments —

Use the following worksheet to determine the prepayments of franchise tax on line 4.

Date Paid

Amount

Mandatory first installment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

CT-400 installments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1)

(2)

(3)

Credit from prior years . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Period

Credit from Form CT-

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Total prepayments

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(add all entries in amount column)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1