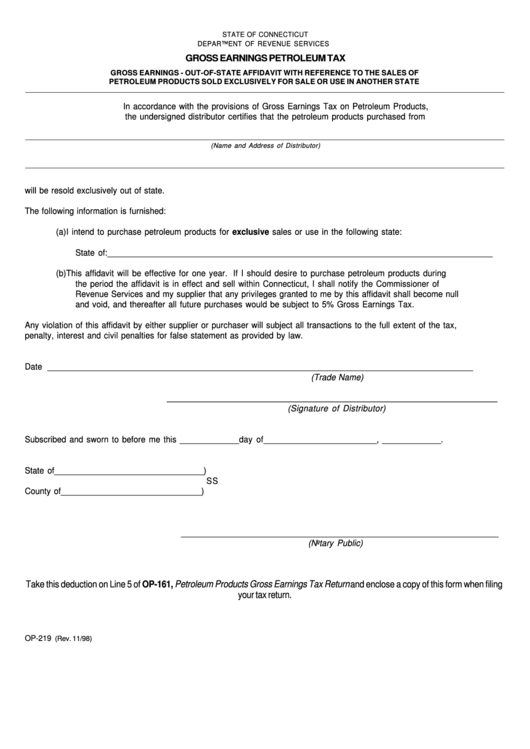

STATE OF CONNECTICUT

DEPARTMENT OF REVENUE SERVICES

GROSS EARNINGS PETROLEUM TAX

GROSS EARNINGS - OUT-OF-STATE AFFIDAVIT WITH REFERENCE TO THE SALES OF

PETROLEUM PRODUCTS SOLD EXCLUSIVELY FOR SALE OR USE IN ANOTHER STATE

In accordance with the provisions of Gross Earnings Tax on Petroleum Products,

the undersigned distributor certifies that the petroleum products purchased from

(Name and Address of Distributor)

will be resold exclusively out of state.

The following information is furnished:

(a) I intend to purchase petroleum products for exclusive sales or use in the following state:

State of: _____________________________________________________________________________________

(b) This affidavit will be effective for one year. If I should desire to purchase petroleum products during

the period the affidavit is in effect and sell within Connecticut, I shall notify the Commissioner of

Revenue Services and my supplier that any privileges granted to me by this affidavit shall become null

and void, and thereafter all future purchases would be subject to 5% Gross Earnings Tax.

Any violation of this affidavit by either supplier or purchaser will subject all transactions to the full extent of the tax,

penalty, interest and civil penalties for false statement as provided by law.

Date _____________________

_________________________________________________________________________

(Trade Name)

_________________________________________________________________________

(Signature of Distributor)

Subscribed and sworn to before me this _____________ day of _________________________ , _____________ .

State of _________________________________ )

SS

County of _______________________________ )

______________________________________________________________________

(Notary Public)

Take this deduction on Line 5 of OP-161, Petroleum Products Gross Earnings Tax Return and enclose a copy of this form when filing

your tax return.

OP-219

(Rev. 11/98)

1

1