Form Esb Black - General Instructions

ADVERTISEMENT

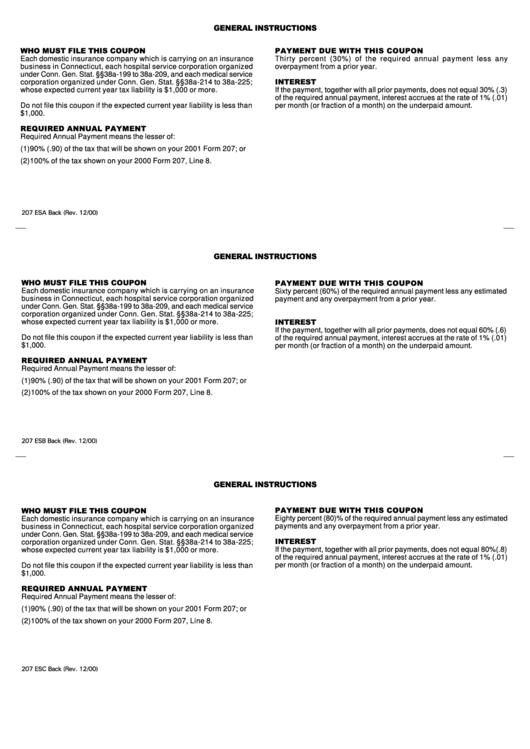

GENERAL INSTRUCTIONS

WHO MUST FILE THIS COUPON

PAYMENT DUE WITH THIS COUPON

Each domestic insurance company which is carrying on an insurance

Thirty percent (30%) of the required annual payment less any

business in Connecticut, each hospital service corporation organized

overpayment from a prior year.

under Conn. Gen. Stat. §§38a-199 to 38a-209, and each medical service

INTEREST

corporation organized under Conn. Gen. Stat. §§38a-214 to 38a-225;

whose expected current year tax liability is $1,000 or more.

If the payment, together with all prior payments, does not equal 30% (.3)

of the required annual payment, interest accrues at the rate of 1% (.01)

Do not file this coupon if the expected current year liability is less than

per month (or fraction of a month) on the underpaid amount.

$1,000.

REQUIRED ANNUAL PAYMENT

Required Annual Payment means the lesser of:

(1) 90% (.90) of the tax that will be shown on your 2001 Form 207; or

(2) 100% of the tax shown on your 2000 Form 207, Line 8.

207 ESA Back (Rev. 12/00)

GENERAL INSTRUCTIONS

WHO MUST FILE THIS COUPON

PAYMENT DUE WITH THIS COUPON

Each domestic insurance company which is carrying on an insurance

Sixty percent (60%) of the required annual payment less any estimated

business in Connecticut, each hospital service corporation organized

payment and any overpayment from a prior year.

under Conn. Gen. Stat. §§38a-199 to 38a-209, and each medical service

corporation organized under Conn. Gen. Stat. §§38a-214 to 38a-225;

INTEREST

whose expected current year tax liability is $1,000 or more.

If the payment, together with all prior payments, does not equal 60% (.6)

Do not file this coupon if the expected current year liability is less than

of the required annual payment, interest accrues at the rate of 1% (.01)

$1,000.

per month (or fraction of a month) on the underpaid amount.

REQUIRED ANNUAL PAYMENT

Required Annual Payment means the lesser of:

(1) 90% (.90) of the tax that will be shown on your 2001 Form 207; or

(2) 100% of the tax shown on your 2000 Form 207, Line 8.

207 ESB Back (Rev. 12/00)

GENERAL INSTRUCTIONS

PAYMENT DUE WITH THIS COUPON

WHO MUST FILE THIS COUPON

Eighty percent (80)% of the required annual payment less any estimated

Each domestic insurance company which is carrying on an insurance

payments and any overpayment from a prior year.

business in Connecticut, each hospital service corporation organized

under Conn. Gen. Stat. §§38a-199 to 38a-209, and each medical service

INTEREST

corporation organized under Conn. Gen. Stat. §§38a-214 to 38a-225;

If the payment, together with all prior payments, does not equal 80%(.8)

whose expected current year tax liability is $1,000 or more.

of the required annual payment, interest accrues at the rate of 1% (.01)

per month (or fraction of a month) on the underpaid amount.

Do not file this coupon if the expected current year liability is less than

$1,000.

REQUIRED ANNUAL PAYMENT

Required Annual Payment means the lesser of:

(1) 90% (.90) of the tax that will be shown on your 2001 Form 207; or

(2) 100% of the tax shown on your 2000 Form 207, Line 8.

207 ESC Back (Rev. 12/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2