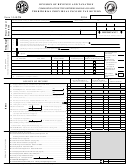

ANNUAL WAGE AND SALARY AND EARNINGS TAX RETURN

2008

Page 2

PART E

COMBINE DUE OR (OVERPAYMENT)

1

Amount due or (overpaid), Chapter 2 and Chapter 7. (add lines 1 of Part C, and line 4 of Part D)

If this amount is an overpayment, skip lines 2 through 4 ……………………………………………………………………....................................... 1

2

CHAPTER 2

:

(b) Failure to File………………………............ 2b

(a) (

Enter amount underpaid

(c) Failure to Pay………………………............ 2c

(c) Interest Charge……………………............. 2d

3

CHAPTER 7

:

(b) Failure to File………………………............ 3b

(a) (

Enter amount underpaid

(c) Failure to Pay………………………............ 3c

(c) Interest Charge……………………............. 3d

4

Total penalty and interest charges. (add lines 2b, 2c, 2d, 3b, 3c, and 3d)…………………………………………………………............................. 4

5

Total amount due or (overpaid), Chapter 2 and Chapter 7. (add lines 1 and 4 of this Part, and lines 5 and 6 of Part D)…….............................. 5

6

If line 5 is an overpayment, enter amount you want credited to your 2009 ESTIMATED TAX………………………………...........................…

6

7

Amount from line 5 you want credited to your 2009 Business Gross Revenue Tax. Indicate the quarter……………..................................… 7

8

Net overpayment............................................................................................................................................................................................... 8

PART F

BUSINESS GROSS REVENUE TAX CREDIT ALLOCATION

Enter the TIN and amount you want credited from line 7, Part E above. The total credit allocation shall be equal to the amount on line 7, Part E above.

TIN

TAX TYPE

AMOUNT

TIN

TAX TYPE

AMOUNT

3105G

3105G

3105AF

3105AF

3105MW

3105MW

PART G

ADDITIONAL CHILD TAX CREDIT COMPUTATION

Special Notice

This Part is provided to enable the Division of Revenue and Taxation to process your claim of the Additional Child Tax Credit (ACTC). Please note that the ACTC is being paid by the

U.S. Treasury, and the Division of Revenue and Taxation is only facilitating your ACTC claim as agreed upon between the CNMI Department of Finance and the U.S. Treasury. By

applying for the ACTC Refund and allowing the refund to be processed by the Division of Revenue and Taxation, you are giving the Division of Revenue and Taxation authorization

to release tax information to the Internal Revenue Service (IRS). See supplemental Instructions for Part F, line 2 regarding rebate offset amount.

1

Additional Child Tax Credit. Enter the amount from line 13 of Form 8812. (Attach Form 8812)…………………….......................................................…… 1

2

Enter the amount underpaid from line 5, Part E above…………………………………………………………………………….................................................… 2

3

Additional Child Tax Credit refund. (subtract line 2 from line 1. but not less than zero)………………………………………............................................…. 3

4

Amount you still owe on this return after offset of the ACTC. (subtract line 2 from line 1. but not less than zero)…….............................................………..

4

Do you want to allow another person to discuss this return with the Division of Revenue and Taxation (see page 57)?

Yes. Complete the following.

No.

Third Party

Designee

Designee’s name

Phone no.

(

)

Personal

number (PIN)

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are

Sign Here

true, correct, and complete. Declaration of preparer (other than the taxpayer) is based on all information of which the preparer has any knowledge.

Joint return?

Your signature

Date

Your occupation

Daytime phone number

See Page 15

(

)

Keep a copy

for Your

Spouse’s signature. If a joint return, both must sign

Date

Spouse’s occupation

Records

Preparer’s

Date

Check if

Preparer’s SSN or PTIN

signature

self-employed

Paid

Preparer’s

EIN

Use Only

Firm’s name (or yours if self-

employed) address and Zip code.

(

)

Phone no.

FOR OFFICIAL USE ONLY

DATE FILED*

DATE PAID

AMOUNT PAID

RECEIPT NO.

VERIFIED BY

POSTED BY

DEADLINE: APRIL 15, 2009

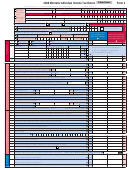

1

1 2

2 3

3 4

4 5

5 6

6