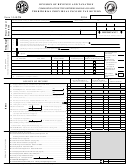

DIVISION OF REVENUE AND TAXATION

COMMONWEALTH OF THE NORTHERN MARIANA ISLANDS

COMPUTATION OF NON-REFUNDABLE CREDIT AND

APPLICATION FOR REBATE ON CNMI SOURCE INCOME TAX

2008

Form OS-3405A

(Attach to Form 1040CM)

(SEE INSTRUCTIONS ON REVERSE SIDE)

Your

name and initial

Last name

Your social security number

If a joint return, spouse’s

name and initial

Last name

Spouse’s social security number

Name and

Address

Home address (number and street).

Apt. No.

IMPORTANT !

City, town, or post

state and ZIP code.

You must enter SSN(s) above

PART A

NON-REFUNDABLE CREDITS

1

Wage and salary tax…………………………………………………………………………….......................................... 1

2

Earnings tax……………………………………………………………………………………............................................ 2

3

Business gross revenue tax

Name

Tax ID No.

a)

a

b)

b

c)

c

4

User fees paid………………………………………………………………………………................................................ 4

5

Fees and taxes imposed under 4CMC § 2202(h)………………………………………................................................ 5

6

Total non-refundable credits (add lines 1 through 5)…………………………………………………………………………………...................................................... 6

PART B

REBATE COMPUTATION

7

Allocable percentage:

a

Tax without the CNMI

7a

%

b

Tax within the CNMI

7b

%

8

Total NMTIT on all sources……………………………………….................................................................................. 8

9

Total NMTIT payments made……………………………………….............................................................................. 9

10

Tax on sources without CNMI. (multiply line 8 by the percentage as shown on line 7a)……………………..................................................................................... 10

11

Tax on sources within CNMI. (multiply line 8 by the percentage as shown on line 7b)….......................................... 11

12

Total non-refundable credits. (enter amount from line 6, Part A)……………………….............................................. 12

13

Rebate base amount. (subtract line 12 from line 11. If zero or less, enter -0-)………………………………………………............................................................ 13

14

Total CNMI and NON-CNMI source tax after non-refundable credits. (add lines 10 and 13)………….......................................................………………………… 14

15

NMTIT overpayment. (subtract line 14 from line 9. If zero or less, enter -0-)………………………………………………….....................................................…… 15

16

NMTIT underpayment. (if line 14 is greater than line 9, subtract line 9 from line 14, otherwise, enter -0-)……………………….................................................... 16

17

Rebate offset amount. Calculate this amount as determined by the rebate base (line 13) using Rebate Table provided in Part B on reverse…....................... 17

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are

true, correct, and complete. Declaration of preparer (other than the taxpayer) is based on all information of which the preparer has any knowledge.

Your signature

Date

Your occupation

Daytime phone number

(

)

Spouse’s signature. If a joint return, both must sign

Date

Spouse’s occupation

Preparer’s

Date

Check if

Preparer’s SSN or PTIN

signature

self-employed

EIN

Firm’s name (or yours if self-

employed) address and Zip code.

(

)

Phone no.

Form OS-3405A-2008

DEADLINE: APRIL 15, 2009

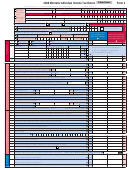

1

1 2

2 3

3 4

4 5

5 6

6