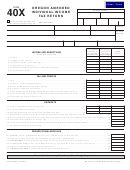

Form Wa - Oregon Agricultural Annual Withholding Tax Return Page 2

ADVERTISEMENT

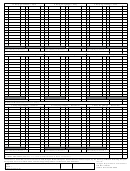

D. Daily Tax Liability — April

E. Daily Tax Liability — May

F. Daily Tax Liability — June

1

16

1

16

1

16

2

17

2

17

2

17

3

18

3

18

3

18

4

19

4

19

4

19

5

20

5

20

5

20

6

21

6

21

6

21

7

22

7

22

7

22

8

23

8

23

8

23

9

24

9

24

9

24

10

25

10

25

10

25

11

26

11

26

11

26

12

27

12

27

12

27

13

28

13

28

13

28

14

29

14

29

14

29

15

30

15

30

15

30

31

31

31

Total Liability for Month D ➛

Total Liability for Month E ➛

Total Liability for Month F ➛

2. Total for Quarter (Add lines D, E, and F) ......................................................................................................................................... ➛

G. Daily Tax Liability — July

H. Daily Tax Liability — August

I. Daily Tax Liability — September

1

16

1

16

1

16

2

17

2

17

2

17

3

18

3

18

3

18

4

19

4

19

4

19

5

20

5

20

5

20

6

21

6

21

6

21

7

22

7

22

7

22

8

23

8

23

8

23

9

24

9

24

9

24

10

25

10

25

10

25

11

26

11

26

11

26

12

27

12

27

12

27

13

28

13

28

13

28

14

29

14

29

14

29

15

30

15

30

15

30

31

31

31

Total Liability for Month G ➛

Total Liability for Month H ➛

Total Liability for Month I ➛

3. Total for Quarter (Add lines G, H, and I) ......................................................................................................................................... ➛

J. Daily Tax Liability — October

K. Daily Tax Liability — November

L. Daily Tax Liability — December

1

16

1

16

1

16

2

17

2

17

2

17

3

18

3

18

3

18

4

19

4

19

4

19

5

20

5

20

5

20

6

21

6

21

6

21

7

22

7

22

7

22

8

23

8

23

8

23

9

24

9

24

9

24

10

25

10

25

10

25

11

26

11

26

11

26

12

27

12

27

12

27

13

28

13

28

13

28

14

29

14

29

14

29

15

30

15

30

15

30

31

31

Total Liability for Month J ➛

Total Liability for Month K ➛

Total Liability for Month L ➛

4. Total for Quarter (Add lines J, K, and L) ......................................................................................................................................... ➛

5. TOTAL FOR YEAR (Add lines 1, 2, 3 and 4) (enter here and in Box 2 on the front) ........................................................................ ➛

In addition to Form WA, be sure to file Form WR, Oregon Withholding Tax Annual Reconciliation Report, by the last day of March following the year

being filed. For more information, call the Oregon Department of Revenue, 503-945-8091.

Mail to:

Oregon Department of Revenue

This report is true, correct, and is filed under penalty of false swearing.

Date

Your Telephone No.

SIGN

PO Box 14800

HERE ➛

Salem OR 97309-0920

150-206-013-1 (Rev. 01-12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2