Instructions For Form Ct-5 - Request For Six-Month Extension To File - 2004

ADVERTISEMENT

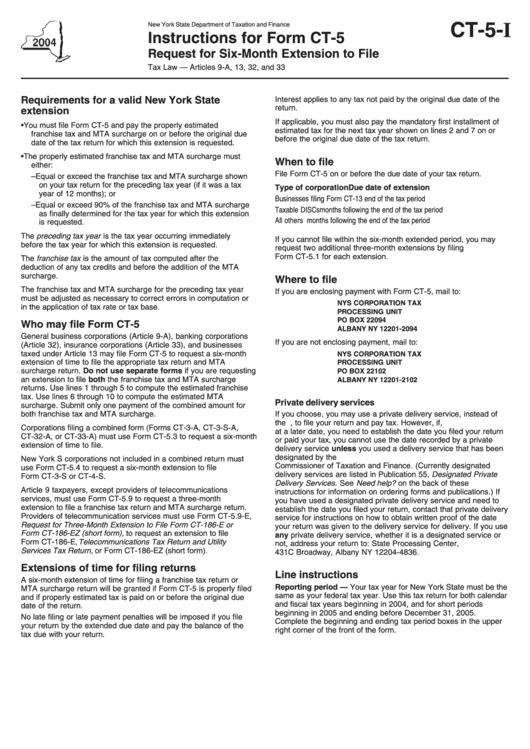

New York State Department of Taxation and Finance

CT-5-I

Instructions for Form CT-5

Request for Six-Month Extension to File

Tax Law — Articles 9-A, 13, 32, and 33

Requirements for a valid New York State

Interest applies to any tax not paid by the original due date of the

return.

extension

If applicable, you must also pay the mandatory first installment of

• You must file Form CT-5 and pay the properly estimated

estimated tax for the next tax year shown on lines 2 and 7 on or

franchise tax and MTA surcharge on or before the original due

before the original due date of the tax return.

date of the tax return for which this extension is requested.

• The properly estimated franchise tax and MTA surcharge must

When to file

either:

File Form CT-5 on or before the due date of your tax return.

– Equal or exceed the franchise tax and MTA surcharge shown

on your tax return for the preceding tax year (if it was a tax

Type of corporation

Due date of extension

year of 12 months); or

Businesses filing Form CT-13 .... 4½ months following the end of the tax period

– Equal or exceed 90% of the franchise tax and MTA surcharge

Taxable DISCs ........................... 8½ months following the end of the tax period

as finally determined for the tax year for which this extension

All others .................................... 2½ months following the end of the tax period

is requested.

The preceding tax year is the tax year occurring immediately

If you cannot file within the six-month extended period, you may

before the tax year for which this extension is requested.

request two additional three-month extensions by filing

Form CT-5.1 for each extension.

The franchise tax is the amount of tax computed after the

deduction of any tax credits and before the addition of the MTA

surcharge.

Where to file

The franchise tax and MTA surcharge for the preceding tax year

If you are enclosing payment with Form CT-5, mail to:

must be adjusted as necessary to correct errors in computation or

NYS CORPORATION TAX

in the application of tax rate or tax base.

PROCESSING UNIT

PO BOX 22094

Who may file Form CT-5

ALBANY NY 12201-2094

General business corporations (Article 9-A), banking corporations

If you are not enclosing payment, mail to:

(Article 32), insurance corporations (Article 33), and businesses

taxed under Article 13 may file Form CT-5 to request a six-month

NYS CORPORATION TAX

extension of time to file the appropriate tax return and MTA

PROCESSING UNIT

surcharge return. Do not use separate forms if you are requesting

PO BOX 22102

an extension to file both the franchise tax and MTA surcharge

ALBANY NY 12201-2102

returns. Use lines 1 through 5 to compute the estimated franchise

tax. Use lines 6 through 10 to compute the estimated MTA

Private delivery services

surcharge. Submit only one payment of the combined amount for

both franchise tax and MTA surcharge.

If you choose, you may use a private delivery service, instead of

the U.S. Postal Service, to file your return and pay tax. However, if,

Corporations filing a combined form (Forms CT-3-A, CT-3-S-A,

at a later date, you need to establish the date you filed your return

CT-32-A, or CT-33-A) must use Form CT-5.3 to request a six-month

or paid your tax, you cannot use the date recorded by a private

extension of time to file.

delivery service unless you used a delivery service that has been

designated by the U.S. Secretary of the Treasury or the

New York S corporations not included in a combined return must

Commissioner of Taxation and Finance. (Currently designated

use Form CT-5.4 to request a six-month extension to file

delivery services are listed in Publication 55, Designated Private

Form CT-3-S or CT-4-S.

Delivery Services. See Need help? on the back of these

Article 9 taxpayers, except providers of telecommunications

instructions for information on ordering forms and publications.) If

services, must use Form CT-5.9 to request a three-month

you have used a designated private delivery service and need to

extension to file a franchise tax return and MTA surcharge return.

establish the date you filed your return, contact that private delivery

Providers of telecommunication services must use Form CT-5.9-E,

service for instructions on how to obtain written proof of the date

Request for Three-Month Extension to File Form CT-186-E or

your return was given to the delivery service for delivery. If you use

Form CT-186-EZ (short form), to request an extension to file

any private delivery service, whether it is a designated service or

Form CT-186-E, Telecommunications Tax Return and Utility

not, address your return to: State Processing Center,

Services Tax Return, or Form CT-186-EZ (short form).

431C Broadway, Albany NY 12204-4836.

Extensions of time for filing returns

Line instructions

A six-month extension of time for filing a franchise tax return or

Reporting period — Your tax year for New York State must be the

MTA surcharge return will be granted if Form CT-5 is properly filed

same as your federal tax year. Use this tax return for both calendar

and if properly estimated tax is paid on or before the original due

and fiscal tax years beginning in 2004, and for short periods

date of the return.

beginning in 2005 and ending before December 31, 2005.

No late filing or late payment penalties will be imposed if you file

Complete the beginning and ending tax period boxes in the upper

your return by the extended due date and pay the balance of the

right corner of the front of the form.

tax due with your return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2