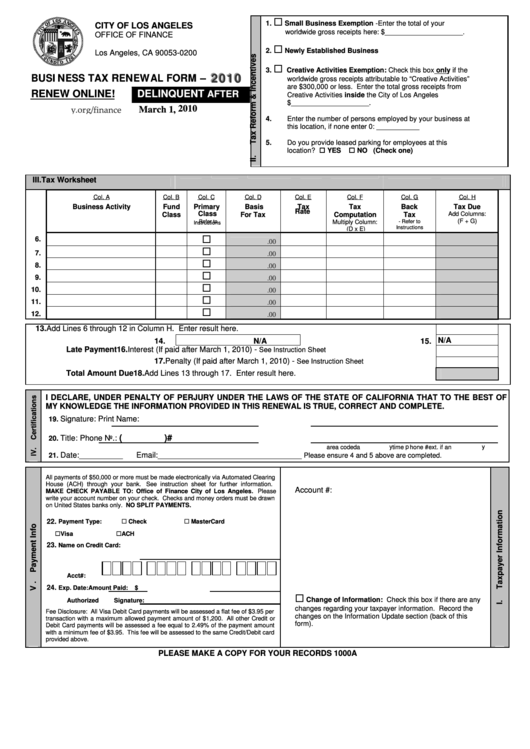

Business Tax Renewal Form - California Office Of Finance - 2010

ADVERTISEMENT

1.

Small Business Exemption - Enter the total of your

CITY OF LOS ANGELES

worldwide gross receipts here: $____________________.

OFFICE OF FINANCE

P.O. Box 53200

2.

Newly Established Business

Los Angeles, CA 90053-0200

3.

Creative Activities Exemption: Check this box only if the

2

0

1

0

2

0

1

0

BUSINESS TAX RENEWAL FORM –

2

0

1

0

worldwide gross receipts attributable to “Creative Activities”

are $300,000 or less. Enter the total gross receipts from

RENEW ONLINE!

DELINQUENT

AFTER

Creative Activities inside the City of Los Angeles

$____________________.

March 1, 2010

4.

Enter the number of persons employed by your business at

this location, if none enter 0: ___________

5.

Do you provide leased parking for employees at this

location?

YES

NO (Check one)

III.

Tax Worksheet

Col. A

Col. B

Col. C

Col. D

Col. E

Col. F

Col. G

Col. H

Business Activity

Fund

Primary

Basis

Tax

Tax

Back

Tax Due

Class

Class

For Tax

Rate

Computation

Tax

Add Columns:

(F + G)

- Refer to

Multiply Column:

- Refer to

Instructions

Instructions

(D x E)

6.

.00

7.

.00

8.

.00

9.

.00

10.

.00

11.

.00

12.

.00

13.

Add Lines 6 through 12 in Column H. Enter result here.

N/A

14.

N/A

15.

Late Payment

16.

Interest (If paid after March 1, 2010) -

See Instruction Sheet

17.

Penalty (If paid after March 1, 2010) -

See Instruction Sheet

Total Amount Due

18.

Add Lines 13 through 17. Enter result here.

I DECLARE, UNDER PENALTY OF PERJURY UNDER THE LAWS OF THE STATE OF CALIFORNIA THAT TO THE BEST OF

MY KNOWLEDGE THE INFORMATION PROVIDED IN THIS RENEWAL IS TRUE, CORRECT AND COMPLETE.

Signature:

Print Name:

19.

(

)

#

Title:

Phone No.:

20.

area code

daytime phone #

ext. if any

Date:

__________

Email:

_________________________________

21.

Please ensure 4 and 5 above are completed.

All payments of $50,000 or more must be made electronically via Automated Clearing

House (ACH) through your bank.

See instruction sheet for further information.

Account #:

MAKE CHECK PAYABLE TO: Office of Finance City of Los Angeles. Please

write your account number on your check. Checks and money orders must be drawn

on United States banks only. NO SPLIT PAYMENTS.

22.

Payment Type:

Check

MasterCard

Visa

ACH

23.

Name on Credit Card:

Acct#:

24.

Exp. Date:

Amount Paid:

$

Change of Information: Check this box if there are any

Authorized Signature:

changes regarding your taxpayer information. Record the

Fee Disclosure: All Visa Debit Card payments will be assessed a flat fee of $3.95 per

changes on the Information Update section (back of this

transaction with a maximum allowed payment amount of $1,200. All other Credit or

form).

Debit Card payments will be assessed a fee equal to 2.49% of the payment amount

with a minimum fee of $3.95. This fee will be assessed to the same Credit/Debit card

provided above.

PLEASE MAKE A COPY FOR YOUR RECORDS

1000A

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2