Form Fr-500 - Combined Business Tax Registration Application Page 2

ADVERTISEMENT

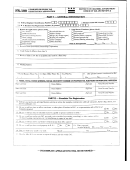

PART III — Employer’s D.C. Withholding Tax Registration

23. Estimated total number of employees __________

24. Number of D.C. resident employees subject to D.C.

Withholding Tax: _______________

25. Date when you began to employ D.C. resident(s) ____-____-____

26. Estimate of amount of D.C. tax to be withheld monthly from

mo. day

yr.

D.C. resident employees:

Date when you began or when you expect to begin to withhold

D.C. tax from resident employees ____-____-____

27. Will you have employee(s) working within D.C.?

mo. day

yr.

Yes

No

PART IV — Sales and Use Tax Registration

28. Check applicable box(es) below

29. Date when sales/use began in D.C. _____-_____-_____

or date expected to begin

mo.

day

yr.

Reporting Sales Tax on retail sales or rentals.

Reporting Use Tax on items purchased tax free inside/outside D.C.

Purchasing in D.C. items for resale outside D.C. (Attach photocopy of state/county sales tax registration.)

Purchasing in D.C. cigarettes for resale outside D.C. (Attach photocopy of state/county cigarette/tobacco license.)

Making no taxable sales and tax is paid to vendors on all taxable purchases.

Making exempt sales where a Certificate of Resale is issued.

30. If you have more than one place of business where you collect taxes on sales in the District of Columbia, do you

wish to file a Combined Sales Tax Return for all locations?

Yes

No

Please attach a statement listing the additional places of business.

PART V1 — Personal Property Tax Registration

Describe the type of Personal Property at each location (ex. furniture, fixtures, machinery equipment and supplies), used for business purposes.

PART V2 — Miscellaneous Tax Registration

Check applicable block(s) below and the appropriate payment booklets/returns will be sent to you.

Alcoholic Beverage Wholesaler

Heating Oil

Cable Television, Satellite Relay or Distribution of Video or Radio Transmission only

Interstate Bus

Cigarette Wholesaler

Motor Vehicle Fuel Tax

Commercial Mobile Service Tax

Natural or Artificial Gas by Non-Public Utility Person

Gross Receipts Public Utility

Toll Telecommunication Service Tax

If you have questions please contact the Customer Service Administration at (202) 727-4829.

CERTIFICATION

I declare under penalties as provided by law that this application (including any accompanying schedules and statements) has been examined by me and

to the best of my knowledge it is correct.

Signature

Title

Date

COMPLETED APPLICATIONS MUST BE SIGNED BY EITHER THE OWNER, PARTNER OR PRINCIPAL OFFICER

OF THE CORPORATION. (Agents or Representatives signing must attach a Power of Attorney.)

OFFICIAL USE ONLY

Type Date Lia.

Tax

began

Cycle

Method

Remarks

H

J

W

S

P

MISC

Reviewer/Date

Date Data Entered/Initials

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4