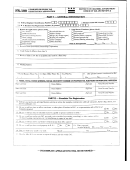

Form Fr-500 - Combined Business Tax Registration Application Page 4

ADVERTISEMENT

12a. Date first wages were paid to employees performing services in D.C.

(write N/A if there were no services performed in D.C.)

This space for official use only.

Month:

Day:

Year:

12b.For household employers only. Do you have an individual in your private

Account Number ______________________________

D.C. residence performing personal, rather than business, services to whom

you pay $500 or more in one calendar quarter?

Yes

No

Date _________________________________________

If yes: indicate the earliest quarter and calendar year when you paid $500 or

more : Quarter: _______ Year: _______

Signature _____________________________________

Check your preference for filing Contribution and Wage Reports:

Quarterly _____

Annually ______

13. Number of workers employed in D.C. (including officers)

14. List all places of business in D.C.

BUSINESS NAME

LOCATION ADDRESS

ZIP CODE

15. If the reason for registering is due to the purchase of a going business, merger, reorganization, or change of legal entity, provide the

following information including the percentage of assets acquired (if needed, attach additional explanation of transaction).

Nature of transfer (check appropriate box):

Purchase

Merger or consolidation

Foreclosure

Receivership

Lease

Corporate Reorganization

Bankruptcy

Assignment

Partnership reorganization (admission or withdrawal of one or more partners).

Other (specify in detail): ______________________________________________________________________________________________

Percent of assets acquired:

%

Date of transfer:

Month:

Day:

Year:

Predecessor’s Name

Predecessor’s Account Number

Address

Trade name under which transferred business was operated

16. COMPLETE THIS PART ONLY IF YOU ARE A NON-PROFIT ORGANIZATION

16a. Are you covered by the Federal Unemployment Tax Act?

16b. Are you a non-profit organization as described in §501(c)(3) of

Yes

No

the United States Internal Revenue Code which is determined to

If NO, are you exempt under §3306(c)(8) of the Federal

be exempt from income tax under §501(a) of such code?

Unemployment Tax Act?

Yes

No

Yes

No

(If yes, please attach a copy of the §501(c)(3) exemption letter.)

16c. Choose an option to finance unemployment insurance coverage (see instructions)

Contributions

Reimbursement of trust fund

CERTIFICATION. I declare under penalties as provided by law that Part VI (including any accompanying schedules and statements) has been examined

by me and to the best of my knowledge it is correct.

Signature

Title

Date

Telephone Number

THE COMPLETED PART VI MUST BE SIGNED BY THE OWNER, PARTNER OR PRINCIPAL OFFICER OF THE

CORPORATION, OR AGENT

(Power of Attorney must be attached if signed by an agent.)

Mail Part VI to: Department of Employment Services

609 H St., N.E., Room 362

Washington, D.C. 20002

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4