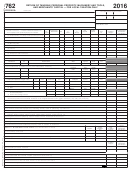

SCHEDULE A FOR FORM 103-SR

JANUARY 1, 2017

Part of State Form 53854 (R8 / 11-16)

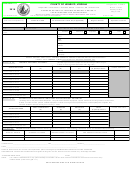

INSTRUCTIONS:

PLEASE TYPE or PRINT.

This form must be filed with the County Assessor of the county in which the property is located not later than May 15, 2017

unless an extension is granted in writing. Contact information for the Assessor is available at

This form is for use by taxpayers who have personal property in more than one (1) township in a county.

If you are claiming any special adjustments such as equipment not placed in service, special tooling, permanently retired equipment,

abnormal obsolescence, economic revitalization, or other deductions, file the Form 103 Long.

Assign a location number to each separate location within a county.

If more than one page is necessary, attach additional forms and indicate you have done so on the front of the Form 103-SR.

NOTE:

The location numbers shown below must correspond with the locations and location numbers shown on the front of this form (Form 103-SR) and on

the reverse side of Form 104-SR.

The County Assessor may refuse to accept a single personal property tax return that does not have attached to it a schedule listing, by township, all the

personal property of the taxpayer and the assessed value of the property for each taxing district as required. [IC 6-1.1-3-7(e)]

DEPRECIABLE PERSONAL PROPERTY

LOCATION NUMBER

#

#

#

TAXING DISTRICT NUMBER

#

#

#

COLUMN A

COLUMN B

COLUMN A

COLUMN B

COLUMN A

COLUMN B

LINE

YEAR OF ACQUISITION

TTV%

TOTAL COST

TTV

TOTAL COST

TTV

TOTAL COST

TTV

1-2-16 to 1-1-17

1

40%

3-2-15 to 1-1-16

2

60%

3-2-14 to 3-1-15

3

55%

3-2-13 to 3-1-14

4

45%

3-2-12 to 3-1-13

5

37%

3-2-11 to 3-1-12

6

30%

3-2-10 to 3-1-11

7

25%

3-2-09 to 3-1-10

8

20%

3-2-08 to 3-1-09

9

16%

3-2-07 to 3-1-08

10

12%

Prior

to 3-2-07

11

10%

TOTALS

12

30% of line 12, Column A

13

Line 14 must be the greater of Line 12, Column B or Line 13 [see 50 IAC 4.2-4-9]

Total True Tax Value (TTV) of

14

Depreciable Personal Property

(to Summary on Form 103-SR)

DEPRECIABLE PERSONAL PROPERTY

LOCATION NUMBER

#

#

#

TAXING DISTRICT NUMBER

#

#

#

COLUMN A

COLUMN B

COLUMN A

COLUMN B

COLUMN A

COLUMN B

LINE

YEAR OF ACQUISITION

TTV%

TOTAL COST

TTV

TOTAL COST

TTV

TOTAL COST

TTV

1

1-2-16 to 1-1-17

40%

2

3-2-15 to 1-1-16

60%

3

3-2-14 to 3-1-15

55%

4

3-2-13 to 3-1-14

45%

5

3-2-12 to 3-1-13

37%

6

3-2-11 to 3-1-12

30%

7

3-2-10 to 3-1-11

25%

8

3-2-09 to 3-1-10

20%

9

3-2-08 to 3-1-09

16%

10

3-2-07 to 3-1-08

12%

11

Prior

to 3-2-07

10%

12

TOTALS

13

30% of line 12, Column A

Line 14 must be the greater of Line 12, Column B or Line 13 [see 50 IAC 4.2-4-9]

Total True Tax Value (TTV) of

14

Depreciable Personal Property

(to Summary on Form 103-SR)

Page ______ of ______

1

1 2

2