Form Dr-133 - Gross Receipts Tax Return - 2003

ADVERTISEMENT

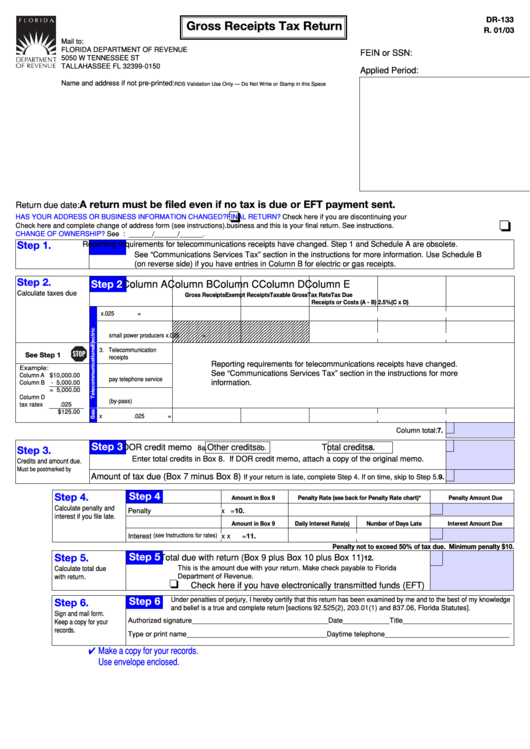

DR-133

Gross Receipts Tax Return

R. 01/03

Mail to:

FLORIDA DEPARTMENT OF REVENUE

FEIN or SSN:

5050 W TENNESSEE ST

TALLAHASSEE FL 32399-0150

Applied Period:

Name and address if not pre-printed:

RDS Validation Use Only — Do Not Write or Stamp in this Space

A return must be filed even if no tax is due or EFT payment sent.

Return due date:

❏

HAS YOUR ADDRESS OR BUSINESS INFORMATION CHANGED?

FINAL RETURN?

Check here if you are discontinuing your

❏

Check here and complete change of address form (see instructions).

business and this is your final return. See instructions.

CHANGE OF OWNERSHIP?

See instructions.

Closing Date: ______/______/______.

Step 1.

Reporting requirements for telecommunications receipts have changed. Step 1 and Schedule A are obsolete.

Step 1

See “Communications Services Tax” section in the instructions for more information. Use Schedule B

(on reverse side) if you have entries in Column B for electric or gas receipts.

Step 2.

Step 2

Column A

Column B

Column C

Column D

Column E

Calculate taxes due

Gross Receipts

Exempt Receipts

Taxable Gross

Tax Rate

Tax Due

Receipts or Costs (A - B)

2.5%

(C x D)

1. Electric receipts

x

.025

=

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

2. Cogenerated or

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

small power producers

x

.025

=

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

3. Telecommunication

See Step 1

receipts

Reporting requirements for telecommunications receipts have changed.

Example:

4. On-site collections local

See “Communications Services Tax” section in the instructions for more

Column A $10,000.00

pay telephone service

information.

Column B - 5,000.00

= 5,000.00

5. Substituted system

Column D

(by-pass)

tax rate

x

.025

$125.00

6. Gas receipts

x

.025

=

Column total:

7.

Step 3

DOR credit memo

Other credits

Total credits

8a.

8b.

8.

Step 3.

Enter total credits in Box 8. If DOR credit memo, attach a copy of the original memo.

Credits and amount due.

Must be postmarked by

Amount of tax due (Box 7 minus Box 8)

If your return is late, complete Step 4. If on time, skip to Step 5.

9.

Step 4

Step 4.

Amount in Box 9

Penalty Rate (see back for Penalty Rate chart)*

Penalty Amount Due

Calculate penalty and

Penalty

x

=10.

interest if you file late.

Amount in Box 9

Daily Interest Rate(s)

Number of Days Late

Interest Amount Due

(see Instructions for rates)

Interest

x

x

=11.

Penalty not to exceed 50% of tax due. Minimum penalty $10.

Step 5

Step 5.

Total due with return (Box 9 plus Box 10 plus Box 11)

12.

This is the amount due with your return. Make check payable to Florida

Calculate total due

Department of Revenue.

with return.

❏

Check here if you have electronically transmitted funds (EFT)

Under penalties of perjury, I hereby certify that this return has been examined by me and to the best of my knowledge

Step 6

Step 6.

and belief is a true and complete return [sections 92.525(2), 203.01(1) and 837.06, Florida Statutes].

Sign and mail form.

Authorized signature___________________________________Date____________Title____________________________

Keep a copy for your

records.

Type or print name____________________________________Daytime telephone________________________________

✔ Make a copy for your records.

Use envelope enclosed.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2