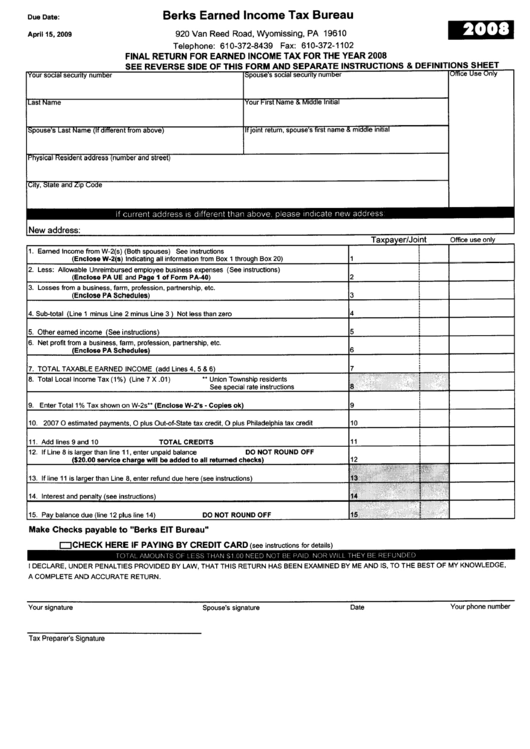

Berks Earned Income Tax Bureau - 2008

ADVERTISEMENT

Due Date:

Berks Earned Income Tax Bureau

April 15, 2009

Em

Tax a er/Joint

Offce use only

1. Earned Income from W-2(s) (Both spouses) See instructions

(Enclose W-2(s) Indicating all information from Box 1 through Box 20)

2. Less: Allowable Unreimbursed employee business expenses (See instructions)

(Enclose PA UE and Page 1 of Form PA-40)

3. Losses from a business, farm, profession, partnership, etc.

(Enclose PA Schedules)

2

3

4. Sub-total (Line 1 minus Line 2 minus Line 3) Not less than zero

4

5. Other earned income (See instructions)

6. Net profit from a business, farm, profession, partnership, etc.

(Enclose PA Schedules)

5

6

7. TOTAL TAXBLE EARNED INCOME (add Lines 4, 5 & 6)

8. Total Local

Income Tax (1 %) (Line 7 X .01) ** Union Township residents

See special rate instructions

9. Enter Total

1 % Tax shown on W-2s** (Enclose W-2's - Copies ok)

9

10. 2007 0 estimated payments, 0 plus Out-of-State tax credit, 0 plus Philadelphia tax credit

10

11. Add lines 9 and 10 TOTAL CREDITS

12. If Line 8 is larger than line 11, enter unpaid balance DO NOT ROUND OFF

($20.00 service char e wil be added to all returned checks)

11

15. Pay balance due (line 12 plus line 14)

DO NOT ROUND OFF

13. If line 11 is larger than Line 8, enter refund due here (see instructions)

14. Interest and penalty (see instructions)

Make Checks payable to "Berks EIT Bureau"

DCHECK HERE IF PAYING BY CREDIT CARD (see instructions for details)

1 OTAL AMOUNTS OF LESS THAN S1 00 NEED NOT BE PAID NOR WILL THEY BE REFUNDED

I DECLARE, UNDER PENALTIES PROVIDED BY LAW, THAT THIS RETURN HAS BEEN EXAMINED BY ME AND IS, TO THE BEST OF MY KNOWLEDGE,

A COMPLETE AND ACCURATE RETURN.

Your signature

Spouse's signature

Date

Your phone number

Tax Preparer's Signature

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2