Instructions For Form Ct-45

ADVERTISEMENT

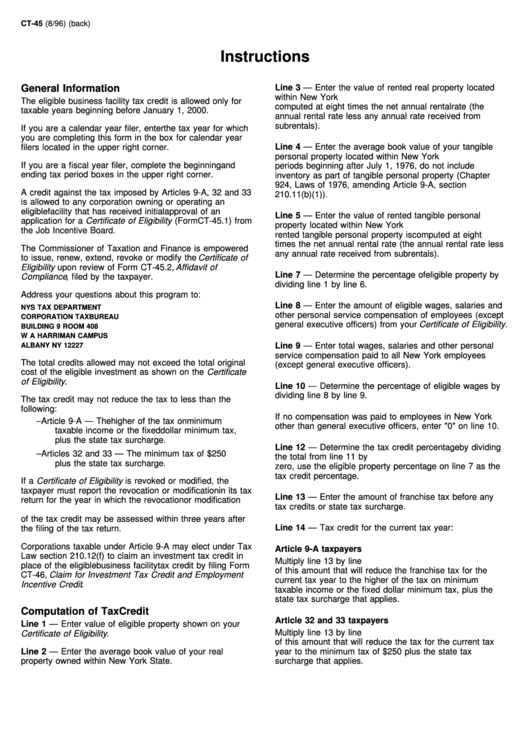

CT-45 (8/96) (back)

Instructions

General Information

Line 3 — Enter the value of rented real property located

within New York State. The value of the rented property is

The eligible business facility tax credit is allowed only for

computed at eight times the net annual rental rate (the

taxable years beginning before January 1, 2000.

annual rental rate less any annual rate received from

subrentals).

If you are a calendar year filer, enter the tax year for which

you are completing this form in the box for calendar year

Line 4 — Enter the average book value of your tangible

filers located in the upper right corner.

personal property located within New York State. For

If you are a fiscal year filer, complete the beginning and

periods beginning after July 1, 1976, do not include

ending tax period boxes in the upper right corner.

inventory as part of tangible personal property (Chapter

924, Laws of 1976, amending Article 9-A, section

A credit against the tax imposed by Articles 9-A, 32 and 33

210.11(b)(1)).

is allowed to any corporation owning or operating an

eligible facility that has received initial approval of an

Line 5 — Enter the value of rented tangible personal

application for a Certificate of Eligibility (Form CT-45.1) from

property located within New York State. The value of the

the Job Incentive Board.

rented tangible personal property is computed at eight

times the net annual rental rate (the annual rental rate less

The Commissioner of Taxation and Finance is empowered

any annual rate received from subrentals).

to issue, renew, extend, revoke or modify the Certificate of

Eligibility upon review of Form CT-45.2, Affidavit of

Line 7 — Determine the percentage of eligible property by

Compliance , filed by the taxpayer.

dividing line 1 by line 6.

Address your questions about this program to:

Line 8 — Enter the amount of eligible wages, salaries and

NYS TAX DEPARTMENT

other personal service compensation of employees (except

CORPORATION TAX BUREAU

general executive officers) from your Certificate of Eligibility .

BUILDING 9 ROOM 408

W A HARRIMAN CAMPUS

ALBANY NY 12227

Line 9 — Enter total wages, salaries and other personal

service compensation paid to all New York employees

The total credits allowed may not exceed the total original

(except general executive officers).

cost of the eligible investment as shown on the Certificate

of Eligibility .

Line 10 — Determine the percentage of eligible wages by

dividing line 8 by line 9.

The tax credit may not reduce the tax to less than the

following:

If no compensation was paid to employees in New York

–

Article 9-A — The higher of the tax on minimum

other than general executive officers, enter "0" on line 10.

taxable income or the fixed dollar minimum tax,

plus the state tax surcharge.

Line 12 — Determine the tax credit percentage by dividing

–

Articles 32 and 33 — The minimum tax of $250

the total from line 11 by two. If the percentage on line 10 is

plus the state tax surcharge.

zero, use the eligible property percentage on line 7 as the

tax credit percentage.

If a Certificate of Eligibility is revoked or modified, the

taxpayer must report the revocation or modification in its tax

Line 13 — Enter the amount of franchise tax before any

return for the year in which the revocation or modification

tax credits or state tax surcharge.

occurs. Any additional tax resulting from the recomputation

of the tax credit may be assessed within three years after

Line 14 — Tax credit for the current tax year:

the filing of the tax return.

Corporations taxable under Article 9-A may elect under Tax

Article 9-A taxpayers

Law section 210.12(f) to claim an investment tax credit in

Multiply line 13 by line 12. Enter this amount or the portion

place of the eligible business facility tax credit by filing Form

of this amount that will reduce the franchise tax for the

CT-46, Claim for Investment Tax Credit and Employment

current tax year to the higher of the tax on minimum

Incentive Credit .

taxable income or the fixed dollar minimum tax, plus the

state tax surcharge that applies.

Computation of Tax Credit

Article 32 and 33 taxpayers

Line 1 — Enter value of eligible property shown on your

Multiply line 13 by line 12. Enter this amount or the portion

Certificate of Eligibility .

of this amount that will reduce the tax for the current tax

Line 2 — Enter the average book value of your real

year to the minimum tax of $250 plus the state tax

property owned within New York State.

surcharge that applies.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1