Form Uct-8a - Correction To Employer'S Quarterly Or Annual Domestic Report - Florida Department Of Revenue Page 2

ADVERTISEMENT

UCT-8A

R. 05/04

Instruction

Page 2

Correction to Employer’s Quarterly or Annual Domestic

Complete Item 8 if individual wage corrections change gross

Report Instructions

wages, excess wages, or taxable wages originally shown on

the tax report.

This form (Form UCT-8A) is provided for use in correcting

errors made on the original Employer’s Quarterly Report

Coupon Completion Instructions

(Form UCT-6) or Annual Report for Employers of Domestic

Write your seven digit account number and the check digit in

Employees Only (UCT-7). Annual filers will need to complete

the boxes provided.

one UCT-8A for each quarter being corrected.

Enter the employer legal entity name in the field labeled “Enter

Under heading “ Correction to Quarter/Year”, insert the quarter

Business Name”.

and year of the original report being corrected. For example,

if the correction is to the 2

nd

quarter 2002, the Correction to

Enter the amount of payment in the “Amount Enclosed” field.

Quarter/Year field would be completed with “2/2002”.

Enter the 1 digit quarter and 2 digit year in the field labeled

Caution: Be sure that the employee’s social security number

“Payment for QTR/YR”. For the quarter field, enter the number

and name shown in Items 1 and 2 agree with your original

“1” for quarter ending March 31

st

, the number “2” for quarter

report, unless the social security number and name

ending June 30

th

, “3” for quarter ending September 30

th

and “4”

st

originally reported were incorrect. In such a case, enter the

for quarter ending December 31

. In the year field, enter the

number and name, as per original report. Underneath, write

last two digits for the year. For example: enter “01” for 2001.

social security number change and/or name change; then

Mail the original completed form and coupon along with

list the correct social security number and/or name.

any remittance due to the:

Item 3 should be completed if continuation sheets were filed

FLORIDA DEPARTMENT OF REVENUE

with original report.

5050 W TENNESSEE STREET

Items 4 and 6 are used to correct gross wages.

TALLAHASSEE FL 32399-0180

Items 5 and 7 should be omitted unless you have received

Need Assistance?

prior approval. Unit codes are special codes assigned

To speak with a Department of Revenue representative, call

employers to identify the mailing address for unemployment

Taxpayer Services, Monday through Friday, 8 a.m. to 7 p.m.,

insurance claims forms, if different from the primary

ET, at 1-800-482-8293.

employer address.

Hearing or speech impaired persons may call the TDD line at

1-800-367-8331 or 850-922-1115.

IMPORTANT

Complete page 1 for corrections to the Employer’s Quarterly or Annual Domestic Report.

Complete page 2 only if payment is enclosed.

Return completed form and coupon, if applicable, to the Department.

DO NOT

DETACH

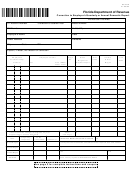

Correction to Employer’s Quarterly or Annual Domestic Report

UCT-8A

Payment Coupon

R. 05/04

COMPLETE and MAIL with Your REPORT/PAYMENT.

Florida Department of Revenue

DOR USE ONLY

Please write ACCOUNT NUMBER on Your Check.

Be sure to SIGN YOUR CHECK.

Make check payable to: Florida U.C. Fund

POSTMARK OR HAND DELIVERY DATE

- - - - -

ACCOUNT NO.

US Dollars

Cents

,

,

F.E.I. NUMBER

AMOUNT ENCLOSED

- - - - -

Q

Y Y

PAYMENT FOR QTR/YR

Name

UCT-8A

Address

Check here if you transmitted funds

City/St/ZIP

electronically.

0100 0 99999999 006805404905050099999990000004

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2