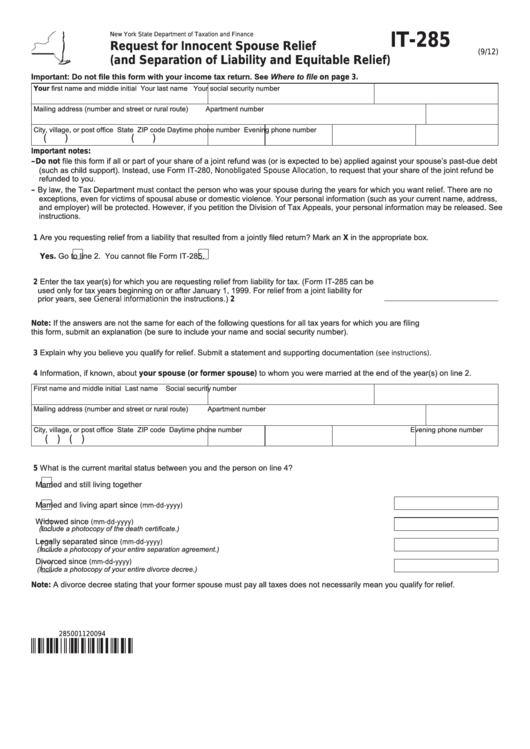

New York State Department of Taxation and Finance

IT-285

Request for Innocent Spouse Relief

(9/12)

(and Separation of Liability and Equitable Relief)

Important: Do not file this form with your income tax return. See Where to file on page 3.

Your first name and middle initial

Your last name

Your social security number

Mailing address (number and street or rural route)

Apartment number

City, village, or post office

State

ZIP code

Daytime phone number

Evening phone number

(

)

(

)

Important notes:

– Do not file this form if all or part of your share of a joint refund was (or is expected to be) applied against your spouse’s past-due debt

(such as child support). Instead, use Form IT-280, Nonobligated Spouse Allocation, to request that your share of the joint refund be

refunded to you.

– By law, the Tax Department must contact the person who was your spouse during the years for which you want relief. There are no

exceptions, even for victims of spousal abuse or domestic violence. Your personal information (such as your current name, address,

and employer) will be protected. However, if you petition the Division of Tax Appeals, your personal information may be released. See

instructions.

1 Are you requesting relief from a liability that resulted from a jointly filed return? Mark an X in the appropriate box.

Yes. Go to line 2.

No. Stop. You cannot file Form IT-285.

2 Enter the tax year(s) for which you are requesting relief from liability for tax. (Form IT-285 can be

used only for tax years beginning on or after January 1, 1999. For relief from a joint liability for

prior years, see General information in the instructions.)............................................................. 2

Note: If the answers are not the same for each of the following questions for all tax years for which you are filing

this form, submit an explanation (be sure to include your name and social security number).

3 Explain why you believe you qualify for relief. Submit a statement and supporting documentation

.

(see instructions)

4 Information, if known, about your spouse (or former spouse) to whom you were married at the end of the year(s) on line 2.

First name and middle initial

Last name

Social security number

Mailing address (number and street or rural route)

Apartment number

City, village, or post office

State

ZIP code

Daytime phone number

Evening phone number

(

)

(

)

5 What is the current marital status between you and the person on line 4?

Married and still living together

Married and living apart since

......................................................................................

(mm-dd-yyyy)

Widowed since

(mm-dd-yyyy)

.....................................................................................

(Include a photocopy of the death certificate.)

Legally separated since

(mm-dd-yyyy)

..................................................................

(Include a photocopy of your entire separation agreement.)

Divorced since

(mm-dd-yyyy)

............................................................................

(Include a photocopy of your entire divorce decree.)

Note: A divorce decree stating that your former spouse must pay all taxes does not necessarily mean you qualify for relief.

285001120094

1

1 2

2 3

3