Instructions For Form Mt-160 - Boxing And Wrestling Exhibitions Tax Return

ADVERTISEMENT

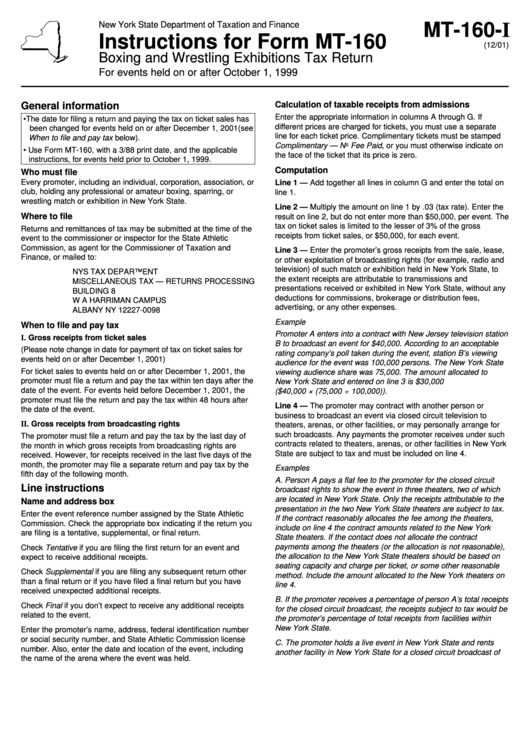

New York State Department of Taxation and Finance

MT-160-I

Instructions for Form MT-160

(12/01)

Boxing and Wrestling Exhibitions Tax Return

For events held on or after October 1, 1999

Calculation of taxable receipts from admissions

General information

Enter the appropriate information in columns A through G. If

• The date for filing a return and paying the tax on ticket sales has

different prices are charged for tickets, you must use a separate

been changed for events held on or after December 1, 2001 (see

line for each ticket price. Complimentary tickets must be stamped

When to file and pay tax below).

Complimentary — No Fee Paid, or you must otherwise indicate on

• Use Form MT-160, with a 3/88 print date, and the applicable

the face of the ticket that its price is zero.

instructions, for events held prior to October 1, 1999.

Computation

Who must file

Every promoter, including an individual, corporation, association, or

Line 1 — Add together all lines in column G and enter the total on

club, holding any professional or amateur boxing, sparring, or

line 1.

wrestling match or exhibition in New York State.

Line 2 — Multiply the amount on line 1 by .03 (tax rate). Enter the

Where to file

result on line 2, but do not enter more than $50,000, per event. The

tax on ticket sales is limited to the lesser of 3% of the gross

Returns and remittances of tax may be submitted at the time of the

receipts from ticket sales, or $50,000, for each event.

event to the commissioner or inspector for the State Athletic

Commission, as agent for the Commissioner of Taxation and

Line 3 — Enter the promoter’s gross receipts from the sale, lease,

Finance, or mailed to:

or other exploitation of broadcasting rights (for example, radio and

television) of such match or exhibition held in New York State, to

NYS TAX DEPARTMENT

the extent receipts are attributable to transmissions and

MISCELLANEOUS TAX — RETURNS PROCESSING

presentations received or exhibited in New York State, without any

BUILDING 8

deductions for commissions, brokerage or distribution fees,

W A HARRIMAN CAMPUS

advertising, or any other expenses.

ALBANY NY 12227-0098

Example

When to file and pay tax

Promoter A enters into a contract with New Jersey television station

I. Gross receipts from ticket sales

B to broadcast an event for $40,000. According to an acceptable

(Please note change in date for payment of tax on ticket sales for

rating company’s poll taken during the event, station B’s viewing

events held on or after December 1, 2001)

audience for the event was 100,000 persons. The New York State

For ticket sales to events held on or after December 1, 2001, the

viewing audience share was 75,000. The amount allocated to

promoter must file a return and pay the tax within ten days after the

New York State and entered on line 3 is $30,000

date of the event. For events held before December 1, 2001, the

($40,000 × (75,000 ÷ 100,000)).

promoter must file the return and pay the tax within 48 hours after

Line 4 — The promoter may contract with another person or

the date of the event.

business to broadcast an event via closed circuit television to

II. Gross receipts from broadcasting rights

theaters, arenas, or other facilities, or may personally arrange for

such broadcasts. Any payments the promoter receives under such

The promoter must file a return and pay the tax by the last day of

contracts related to theaters, arenas, or other facilities in New York

the month in which gross receipts from broadcasting rights are

State are subject to tax and must be included on line 4.

received. However, for receipts received in the last five days of the

month, the promoter may file a separate return and pay tax by the

Examples

fifth day of the following month.

A. Person A pays a flat fee to the promoter for the closed circuit

Line instructions

broadcast rights to show the event in three theaters, two of which

are located in New York State. Only the receipts attributable to the

Name and address box

presentation in the two New York State theaters are subject to tax.

Enter the event reference number assigned by the State Athletic

If the contract reasonably allocates the fee among the theaters,

Commission. Check the appropriate box indicating if the return you

include on line 4 the contract amounts related to the New York

are filing is a tentative, supplemental, or final return.

State theaters. If the contact does not allocate the contract

payments among the theaters (or the allocation is not reasonable),

Check Tentative if you are filing the first return for an event and

the allocation to the New York State theaters should be based on

expect to receive additional receipts.

seating capacity and charge per ticket, or some other reasonable

Check Supplemental if you are filing any subsequent return other

method. Include the amount allocated to the New York theaters on

than a final return or if you have filed a final return but you have

line 4.

received unexpected additional receipts.

B. If the promoter receives a percentage of person A’s total receipts

Check Final if you don’t expect to receive any additional receipts

for the closed circuit broadcast, the receipts subject to tax would be

related to the event.

the promoter’s percentage of total receipts from facilities within

New York State.

Enter the promoter’s name, address, federal identification number

or social security number, and State Athletic Commission license

C. The promoter holds a live event in New York State and rents

number. Also, enter the date and location of the event, including

another facility in New York State for a closed circuit broadcast of

the name of the arena where the event was held.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2