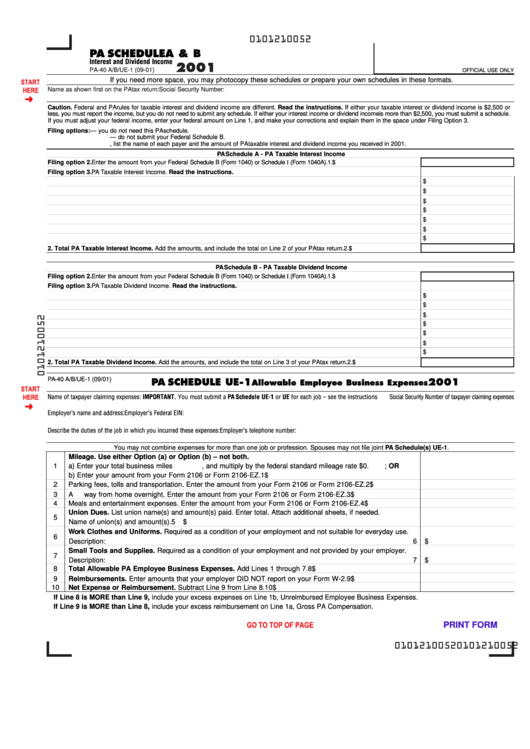

0101210052

PA SCHEDULE A & B

Interest and Dividend Income

2001

PA-40 A/B/UE-1 (09-01)

OFFICIAL USE ONLY

If you need more space, you may photocopy these schedules or prepare your own schedules in these formats.

START

HERE

Name as shown first on the PA tax return:

Social Security Number:

Caution. Federal and PA rules for taxable interest and dividend income are different. Read the instructions. If either your taxable interest or dividend income is $2,500 or

less, you must report the income, but you do not need to submit any schedule. If either your interest income or dividend income is more than $2,500, you must submit a schedule.

If you must adjust your federal income, enter your federal amount on Line 1, and make your corrections and explain them in the space under Filing Option 3.

Filing options:

1.

Submit a copy of your federal schedule — you do not need this PA schedule.

2.

Enter your federal taxable interest and/or dividend income — do not submit your Federal Schedule B.

3.

Otherwise, list the name of each payer and the amount of PA taxable interest and dividend income you received in 2001.

PA Schedule A - PA Taxable Interest Income

Filing option 2.

Enter the amount from your Federal Schedule B (Form 1040) or Schedule I (Form 1040A).

1. $

Filing option 3.

PA Taxable Interest Income. Read the instructions.

$

$

$

$

$

$

$

2. Total PA Taxable Interest Income. Add the amounts, and include the total on Line 2 of your PA tax return.

2. $

IMPORTANT. Capital gain distributions are dividend income for PA purposes.

PA Schedule B - PA Taxable Dividend Income

Filing option 2.

Enter the amount from your Federal Schedule B (Form 1040) or Schedule I (Form 1040A).

1. $

Filing option 3.

PA Taxable Dividend Income. Read the instructions.

$

$

$

$

$

$

$

2. Total PA Taxable Dividend Income. Add the amounts, and include the total on Line 3 of your PA tax return.

2. $

PA-40 A/B/UE-1 (09/01)

PA SCHEDULE UE-1

2001

Allowable Employee Business Expenses

START

HERE

Name of taxpayer claiming expenses: IMPORTANT. You must submit a PA Schedule UE-1 or UE for each job – see the instructions

Social Security Number of taxpayer claiming expenses

Employer’s name and address:

Employer’s Federal EIN:

Describe the duties of the job in which you incurred these expenses:

Employer’s telephone number:

You may not combine expenses for more than one job or profession. Spouses may not file joint PA Schedule(s) UE-1.

Mileage. Use either Option (a) or Option (b) – not both.

1

a) Enter your total business miles

, and multiply by the federal standard mileage rate $0.

; OR

b) Enter your amount from your Form 2106 or Form 2106-EZ.

1

$

2

Parking fees, tolls and transportation. Enter the amount from your Form 2106 or Form 2106-EZ.

2

$

3

Away from home overnight. Enter the amount from your Form 2106 or Form 2106-EZ.

3

$

4

Meals and entertainment expenses. Enter the amount from your Form 2106 or Form 2106-EZ.

4

$

Union Dues. List union name(s) and amount(s) paid. Enter total. Attach additional sheets, if needed.

5

Name of union(s) and amount(s).

5

$

Work Clothes and Uniforms. Required as a condition of your employment and not suitable for everyday use.

6

Description:

6

$

Small Tools and Supplies. Required as a condition of your employment and not provided by your employer.

7

Description:

7

$

8

Total Allowable PA Employee Business Expenses. Add Lines 1 through 7.

8

$

9

Reimbursements. Enter amounts that your employer DID NOT report on your Form W-2.

9

$

10

Net Expense or Reimbursement. Subtract Line 9 from Line 8.

10

$

If Line 8 is MORE than Line 9, include your excess expenses on Line 1b, Unreimbursed Employee Business Expenses.

If Line 9 is MORE than Line 8, include your excess reimbursement on Line 1a, Gross PA Compensation.

GO TO TOP OF PAGE

PRINT FORM

Reset Entire Form

0101210052

0101210052

1

1