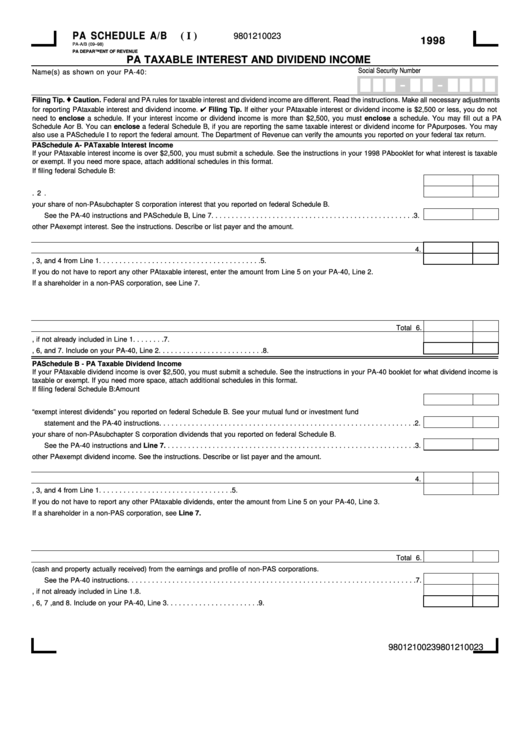

PA SCHEDULE A/B

( I )

9801210023

1998

PA-A/B (09–98)

PA DEPARTMENT OF REVENUE

PA TAXABLE INTEREST AND DIVIDEND INCOME

Social Security Number

Name(s) as shown on your PA -40:

-

-

Filing Tip.

Caution. Federal and PA rules for taxable interest and dividend income are different. Read the instructions. Make all necessary adjustments

for reporting PA taxable interest and dividend income.

Filing Tip. If either your PA taxable interest or dividend income is $2,500 or less, you do not

need to enclose a schedule. If your interest income or dividend income is more than $2,500, you must enclose a schedule. You may fill out a PA

Schedule A or B. You can enclose a federal Schedule B, if you are reporting the same taxable interest or dividend income for PA purposes. You may

also use a PA Schedule I to report the federal amount. The Department of Revenue can verify the amounts you reported on your federal tax return.

PA Schedule A - PA Taxable Interest Income

If your PA taxable interest income is over $2,500, you must submit a schedule. See the instructions in your 1998 PA booklet for what interest is taxable

or exempt. If you need more space, attach additional schedules in this format.

If filing federal Schedule B:

1. Enter the amount from Line 4 from your federal Schedule B . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.

2. Subtract PA exempt interest that you reported as taxable on federal Schedule B. See the PA-40 instructions. . . . . . . . . . . 2.

3. Subtract your share of non-PA subchapter S corporation interest that you reported on federal Schedule B.

See the PA-40 instructions and PA Schedule B, Line 7. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .3.

4. Subtract other PA exempt interest. See the instructions. Describe or list payer and the amount.

4.

5. Adjusted PA taxable interest. Subtract Lines 2, 3, and 4 from Line 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.

If you do not have to report any other PA taxable interest, enter the amount from Line 5 on your PA-40, Line 2.

If a shareholder in a non-PA S corporation, see Line 7.

6. Add other PA taxable interest. See the instructions. List each payer and the amount.

Total 6.

7. Enter your total PA taxable interest from partnerships and PA S corporations, if not already included in Line 1. . . . . . . . 7.

8. Total PA taxable interest income. Add Lines 5, 6, and 7. Include on your PA-40, Line 2. . . . . . . . . . . . . . . . . . . . . . . . . . 8.

PA Schedule B - PA Taxable Dividend Income

If your PA taxable dividend income is over $2,500, you must submit a schedule. See the instructions in your PA-40 booklet for what dividend income is

taxable or exempt. If you need more space, attach additional schedules in this format.

If filing federal Schedule B:

Amount

1. Enter the amount from Line 6 of your federal Schedule B. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.

2. Subtract PA “exempt interest dividends” you reported on federal Schedule B. See your mutual fund or investment fund

statement and the PA-40 instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

3. Subtract your share of non-PA subchapter S corporation dividends that you reported on federal Schedule B.

See the PA-40 instructions and Line 7. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

4. Subtract other PA exempt dividend income. See the instructions. Describe or list payer and the amount.

4.

5. Adjusted PA taxable dividend income. Subtract Lines 2, 3, and 4 from Line 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.

If you do not have to report any other PA taxable dividends, enter the amount from Line 5 on your PA-40, Line 3.

If a shareholder in a non-PA S corporation, see Line 7.

6. Add other PA taxable dividend income. See the instructions. Describe or list payer and the amount.

Total 6.

7. Enter your total dividends (cash and property actually received) from the earnings and profile of non-PA S corporations.

See the PA-40 instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.

8. Enter your total PA taxable dividend income from partnerships and PA S corporations, if not already included in Line 1. 8.

9. Total PA taxable dividend income. Add Lines 5, 6, 7 ,and 8. Include on your PA-40, Line 3. . . . . . . . . . . . . . . . . . . . . . . 9.

9801210023

9801210023

1

1