Form 24740 - Application For Property Tax Exemption - 2004

ADVERTISEMENT

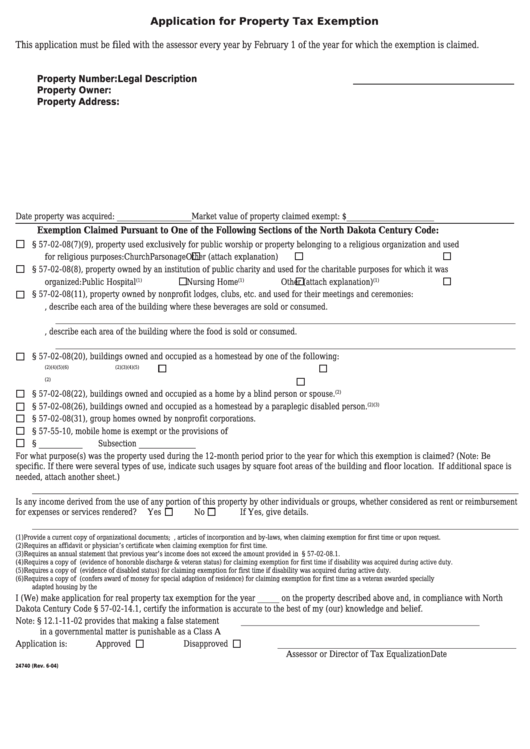

Application for Property Tax Exemption

This application must be filed with the assessor every year by February 1 of the year for which the exemption is claimed.

Property Number:

Legal Description

Property Owner:

Property Address:

Date property was acquired: _________________

Market value of property claimed exempt: $____________________

Exemption Claimed Pursuant to One of the Following Sections of the North Dakota Century Code:

1. N.D.C.C. § 57-02-08(7)(9), property used exclusively for public worship or property belonging to a religious organization and used

for religious purposes:

Church

Parsonage

Other (attach explanation)

2. N.D.C.C. § 57-02-08(8), property owned by an institution of public charity and used for the charitable purposes for which it was

(1)

(1)

(1)

organized:

Public Hospital

Nursing Home

Other (attach explanation)

3. N.D.C.C. § 57-02-08(11), property owned by nonprofit lodges, clubs, etc. and used for their meetings and ceremonies:

a. If licensed to sell alcoholic beverages, describe each area of the building where these beverages are sold or consumed.

________________________________________________________________________________________________________

b. If food is sold, describe each area of the building where the food is sold or consumed.

________________________________________________________________________________________________________

4. N.D.C.C. § 57-02-08(20), buildings owned and occupied as a homestead by one of the following:

(2)(4)(5)(6)

(2)(3)(4)(5)

a. Paraplegic Disabled Veteran

b. Disabled Veteran

c. Permanently and Totally Disabled Person Confined to a Wheelchair

(2)

(2)

5. N.D.C.C. § 57-02-08(22), buildings owned and occupied as a home by a blind person or spouse.

(2)(3)

6. N.D.C.C. § 57-02-08(26), buildings owned and occupied as a homestead by a paraplegic disabled person.

7. N.D.C.C. § 57-02-08(31), group homes owned by nonprofit corporations.

8. N.D.C.C. § 57-55-10, mobile home is exempt or the provisions of N.D.C.C. ch. 57-55 apply.

9. N.D.C.C. § __________

Subsection _____________

For what purpose(s) was the property used during the 12-month period prior to the year for which this exemption is claimed? (Note: Be

specific. If there were several types of use, indicate such usages by square foot areas of the building and floor location. If additional space is

needed, attach another sheet.)

______________________________________________________________________________________________________________

Is any income derived from the use of any portion of this property by other individuals or groups, whether considered as rent or reimbursement

for expenses or services rendered?

Yes

No

If Yes, give details.

______________________________________________________________________________________________________________

(1)

Provide a current copy of organizational documents; e.g., articles of incorporation and by-laws, when claiming exemption for first time or upon request.

(2)

Requires an affidavit or physician’s certificate when claiming exemption for first time.

(3)

Requires an annual statement that previous year’s income does not exceed the amount provided in N.D.C.C. § 57-02-08.1.

(4)

Requires a copy of V.A. Form DD-214 (evidence of honorable discharge & veteran status) for claiming exemption for first time if disability was acquired during active duty.

(5)

Requires a copy of V.A. Certificate of Eligibility (evidence of disabled status) for claiming exemption for first time if disability was acquired during active duty.

(6)

Requires a copy of V.A. Rating Decision (confers award of money for special adaption of residence) for claiming exemption for first time as a veteran awarded specially

adapted housing by the V.A.

I (We) make application for real property tax exemption for the year _____ on the property described above and, in compliance with North

Dakota Century Code § 57-02-14.1, certify the information is accurate to the best of my (our) knowledge and belief.

Note: N.D.C.C. § 12.1-11-02 provides that making a false statement

______________________________________________________

in a governmental matter is punishable as a Class A misdemeanor.

Applicant

Date

Application is:

Approved

Disapproved

______________________________________________________

Assessor or Director of Tax Equalization

Date

24740 (Rev. 6-04)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1