Instructions For Form St-16 - Kansas Retailers' Sales Tax Return - 2005 Page 4

ADVERTISEMENT

2

The deduction also may be claimed by vendors that honor a Form PR-74c, State Rate

Increase Exemption Certificate, and charge state sales tax at the 5.3% state rate on certain

construction materials sold after the rate increase. The deduction also may be claimed by

subcontractors that honor a Form PR-74c for their taxable labor service charges.

Senate Substitute For House Bill 2360, which increased the state sales tax rate from

5.3% to 6.3%, contains a transition provision for construction contracts entered into

before May 1, 2010. This provision allows materials and services that are purchased

under a qualifying construction contract to be taxed at the 5.3% state rate even though the

purchases are made or services performed after the state rate increase on July 1, 2010.

This provision and its application are discussed in Notice 10-02, as revised on June 3,

2010. To benefit from it, the general contractor must complete an electronic application

found on the department's web site --- --- and submit the required

documentation to the department on or before July 10, 2010. This transition provision

only applies to binding written construction contracts that were signed by all contracting

parties before May 1, 2010.

When an application is approved, the department will issue a Form PR-74c, State

Rate Increase Exemption Certificate, to the general contractor which allows vendors to

charge the lower 5.3% state rate on materials sold after the rate increase for the qualifying

project. Copies of this form should be completed by the general contractor and

subcontractors and given to vendors after the rate increase.

A vendor that honors a Form PR-74c Certificate should charge the buyer the

combined state and local sales tax rate in place at the time of sale, but not including the

1% state rate increase. These sales are sourced in the same way as any other sales. Any

local sales tax rate increase that takes effect on July 1, 2010 must be included in the

combined state and local sales tax rate.

If a vendor refuses to honor a Form PR-74c Certificate, the contractor's remedy is to

pay the tax to the vendor as invoiced at the 6.3% state rate and submit a refund claim to

the department using department Form ST-21.

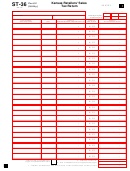

IV. Claiming the Deduction on a Return. Kansas sales tax returns do not allow two

state rates to be reported on one return. Because of this, businesses that file one return

reporting some sales invoiced to customers at the 5.3% state rate, and other sales invoiced

at the 6.3% state rate, are required to keep a record of the sales invoiced during the

reporting period at the 5.3% state rate. The gross sales receipts from these sales should be

totaled and the sum multiplied by a Factor to arrive at a deduction the retailer can claim

on the return. After the deduction is taken, the total tax being reported on the return

should correctly match the total tax the retailer collected on the sales invoiced at 5.3%

state rate and the sales invoiced at the 6.3% state rate.

These deductions and how they are calculated are discussed below in Sections V and

VI. The Factors and how they are arrived at are discussed below in Sections VII and VIII.

V. Filing a July 2010 ST-16 Return. Businesses that report any sales invoiced to

customers at the 5.3% state rate on an ST-16 filed for July 2010, or for a later reporting

period, must keep track of the sales receipts they report on the return correctly invoiced at

the 5.3% state rate.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7