Instructions For Form St-16 - Kansas Retailers' Sales Tax Return - 2005 Page 5

ADVERTISEMENT

3

When filling out the ST-16, a retailer should report its Gross Sales and other amounts,

such as "Sales to other retailers for resale" and "Returned goods, discounts, allowances

and trade-ins," in the same way the retailer entered them on ST-16's filed for periods

before July 2010. Gross Sales include sales that were invoiced to customers at the 5.3%

state rate as well as sales that were invoiced at the 6.3% state rate.

To calculate the deduction amount that can be claimed because of the rate increase,

the retailer should total the sales receipts invoiced at the 5.3% state rate and multiple the

sum by the correct Factor selected from the Factor Table below. The result of this

multiplication should be entered in Part II of the ST-16 on Line N, "Other allowable

deductions." The "Total Deductions" on Line O of Part II must be entered on Line 3 of

Part I, "Total allowable deduction."

A Form ST-16 return reports Kansas state and local sales tax for one Kansas taxing

jurisdiction. Each different taxing jurisdiction is assigned a unique Taxing Jurisdiction

Code under which sales are reported. To find the appropriate Factor in the Factor Table

below, a retailer must determine the combined sales tax rate in place for the Taxing

Jurisdiction Code immediately before July 1, 2010 and the combined rate in place for the

same Code on July 1, 2010. The decimal amount that follows the two combined rates

listed in the Factor Table is the Factor that should be used to determine the deduction

amount being claimed.

Retailers that claim this deduction must maintain, for a minimum of three years,

copies of their worksheets, computer printouts, any Form PR-74c's they receive, their

records of sales taxed at the 5.3% rate, and any other records that support claimed

deductions.

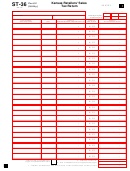

VI. Filing a July 2010 ST-36 Return. Businesses reporting sales sourced to more than

one taxing jurisdiction should use the ST-36. Businesses that report sales that were

correctly invoiced to customers at the 5.3% state rate on an ST-36 filed for July 2010, or

for a later reporting period, must keep track of the sales receipts being reported on the

return that were correctly invoiced at the 5.3% state rate for each Taxing Jurisdiction

Code being reported.

To complete the ST-36 return, the retailer should enter its Gross Sales in the same

way that the retailer reported the amounts on ST-36's filed for periods before July 2010.

Gross Sales include sales that were invoiced to customers at the 5.3% state rate as well as

sales that were invoiced at the 6.3% state rate.

To determine the deduction allowed because of the rate increase, the retailer will total

the sales receipts being reported that were invoiced at the 5.3% state rate for each Taxing

Jurisdiction Code under which sales receipts are being reported. The sum of the 5.3%

state rate sales for a taxing jurisdiction should be multiplied by the Factor that is

appropriate for that taxing jurisdiction from the Factor Table, below. The result of this

multiplication should be entered in Part III of the ST-36 on the Line in Column labeled

"Part II Deductions (Non-Utility)" that corresponds to the Taxing Jurisdiction identified

for that Line in the first Column labeled "Taxing Jurisdictions." The amount of the total

deductions being reported in the Column "Part II Deductions (Non-Utility)" in Part III to

adjust for the 5.3% state rate sales must also be entered on Part II on Line N, "Other

allowable deductions."

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7