Instructions For Business Consumer'S Use Tax Return And Work Sheet

ADVERTISEMENT

i L

t s

A

l l

P

u

c r

h

a

s

e

s

f o

T

a

n

g

b i

e l

P

e

s r

o

n

l a

P

o r

p

r e

y t

S

u

b

e j

t c

o t

h t

e

U

s

e

T

a

x

N

a

m

e

a

n

d

A

d

d

e r

s s

f o

S

l l e

r e

D

e

s

i r c

t p

o i

n

f o

P

o r

p

r e

y t

P

u

c r

h

a

s

e

d

D

a

e t

f o

P

u

c r

h

a

s

e

C

o

t s

r P

c i

e

f O

P

o r

p

r e

y t

P

u

c r

h

a

s

e

d

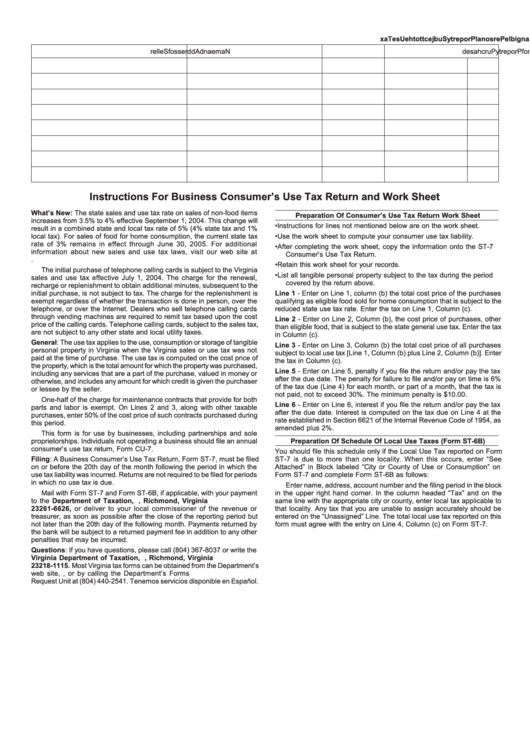

Instructions For Business Consumer’s Use Tax Return and Work Sheet

What’s New: The state sales and use tax rate on sales of non-food items

Preparation Of Consumer’s Use Tax Return Work Sheet

increases from 3.5% to 4% effective September 1, 2004. This change will

•

Instructions for lines not mentioned below are on the work sheet.

result in a combined state and local tax rate of 5% (4% state tax and 1%

local tax). For sales of food for home consumption, the current state tax

•

Use the work sheet to compute your consumer use tax liability.

rate of 3% remains in effect through June 30, 2005. For additional

•

After completing the work sheet, copy the information onto the ST-7

information about new sales and use tax laws, visit our web site at

Consumer’s Use Tax Return.

•

Retain this work sheet for your records.

The initial purchase of telephone calling cards is subject to the Virginia

•

List all tangible personal property subject to the tax during the period

sales and use tax effective July 1, 2004. The charge for the renewal,

covered by the return above.

recharge or replenishment to obtain additional minutes, subsequent to the

initial purchase, is not subject to tax. The charge for the replenishment is

Line 1 - Enter on Line 1, column (b) the total cost price of the purchases

exempt regardless of whether the transaction is done in person, over the

qualifying as eligible food sold for home consumption that is subject to the

telephone, or over the Internet. Dealers who sell telephone calling cards

reduced state use tax rate. Enter the tax on Line 1, Column (c).

through vending machines are required to remit tax based upon the cost

Line 2 - Enter on Line 2, Column (b), the cost price of purchases, other

price of the calling cards. Telephone calling cards, subject to the sales tax,

than eligible food, that is subject to the state general use tax. Enter the tax

are not subject to any other state and local utility taxes.

in Column (c).

General: The use tax applies to the use, consumption or storage of tangible

Line 3 - Enter on Line 3, Column (b) the total cost price of all purchases

personal property in Virginia when the Virginia sales or use tax was not

subject to local use tax [Line 1, Column (b) plus Line 2, Column (b)]. Enter

paid at the time of purchase. The use tax is computed on the cost price of

the tax in Column (c).

the property, which is the total amount for which the property was purchased,

Line 5 - Enter on Line 5, penalty if you file the return and/or pay the tax

including any services that are a part of the purchase, valued in money or

after the due date. The penalty for failure to file and/or pay on time is 6%

otherwise, and includes any amount for which credit is given the purchaser

of the tax due (Line 4) for each month, or part of a month, that the tax is

or lessee by the seller.

not paid, not to exceed 30%. The minimum penalty is $10.00.

One-half of the charge for maintenance contracts that provide for both

Line 6 - Enter on Line 6, interest if you file the return and/or pay the tax

parts and labor is exempt. On Lines 2 and 3, along with other taxable

after the due date. Interest is computed on the tax due on Line 4 at the

purchases, enter 50% of the cost price of such contracts purchased during

rate established in Section 6621 of the Internal Revenue Code of 1954, as

this period.

amended plus 2%.

This form is for use by businesses, including partnerships and sole

proprietorships. Individuals not operating a business should file an annual

Preparation Of Schedule Of Local Use Taxes (Form ST-6B)

consumer’s use tax return, Form CU-7.

You should file this schedule only if the Local Use Tax reported on Form

Filing: A Business Consumer’s Use Tax Return, Form ST-7, must be filed

ST-7 is due to more than one locality. When this occurs, enter “See

on or before the 20th day of the month following the period in which the

Attached” in Block labeled “City or County of Use or Consumption” on

use tax liability was incurred. Returns are not required to be filed for periods

Form ST-7 and complete Form ST-6B as follows:

in which no use tax is due.

Enter name, address, account number and the filing period in the block

Mail with Form ST-7 and Form ST-6B, if applicable, with your payment

in the upper right hand corner. In the column headed “Tax” and on the

to the Department of Taxation, P.O. Box 26626, Richmond, Virginia

same line with the appropriate city or county, enter local tax applicable to

23261-6626, or deliver to your local commissioner of the revenue or

that locality. Any tax that you are unable to assign accurately should be

treasurer, as soon as possible after the close of the reporting period but

entered on the “Unassigned” Line. The total local use tax reported on this

not later than the 20th day of the following month. Payments returned by

form must agree with the entry on Line 4, Column (c) on Form ST-7.

the bank will be subject to a returned payment fee in addition to any other

penalties that may be incurred.

Questions: If you have questions, please call (804) 367-8037 or write the

Virginia Department of Taxation, P.O. Box 1115, Richmond, Virginia

23218-1115. Most Virginia tax forms can be obtained from the Department’s

web site, , or by calling the Department’s Forms

Request Unit at (804) 440-2541. Tenemos servicios disponible en Español.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1