Oklahoma Consumer Use Tax Report Instructions

ADVERTISEMENT

Column K -

Multiply the amount in Column J by the applicable rate

GENERAL INSTRUCTIONS

and enter the amount of city/county tax due.

Please write only in the white areas.

Column L -

If this report and remittance is postmarked after the due

date shown in Item C the tax is subject to interest and

Please use a #2 pencil or pen with black ink to mark your entries

penalty from the due date until it is paid. Multiply the

on this form. If you type your report, please type "XXX" over

amount in Column K by the applicable rates for each

"222" in box P. at the top of the form. If your mailing 'address or

month or part thereof that the report is late.

your business address has changed place an "X" in the proper

Box F and enter the correct information in space provided below.

Column M -

Total Column K and Column L for each city listed.

If you are not required to file this form, call the Oklahoma Tax

Commission at (405) 521-3160.

Column N -

Enter the code for each city or county for which you are

remitting tax.

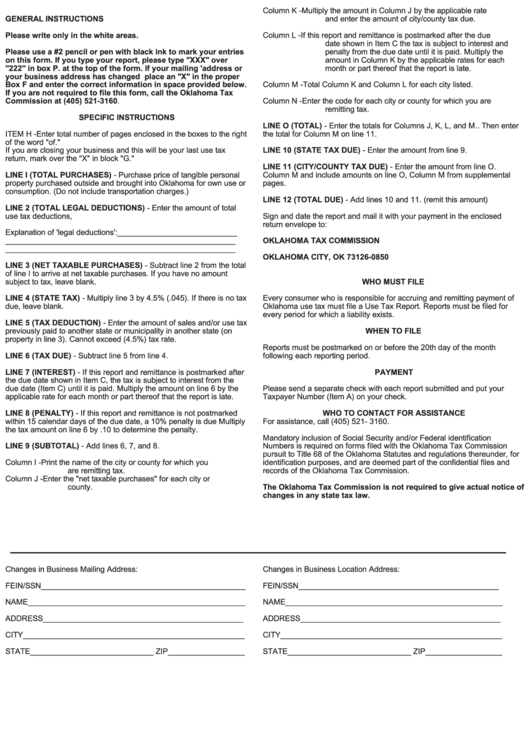

SPECIFIC INSTRUCTIONS

LINE O (TOTAL) - Enter the totals for Columns J, K, L, and M.. Then enter

ITEM H -Enter total number of pages enclosed in the boxes to the right

the total for Column M on line 11.

of the word "of."

If you are closing your business and this will be your last use tax

LINE 10 (STATE TAX DUE) - Enter the amount from line 9.

return, mark over the "X" in block "G."

LINE 11 (CITY/COUNTY TAX DUE) - Enter the amount from line O.

LINE I (TOTAL PURCHASES) - Purchase price of tangible personal

Column M and include amounts on line O, Column M from supplemental

property purchased outside and brought into Oklahoma for own use or

pages.

consumption. (Do not include transportation charges.)

LINE 12 (TOTAL DUE) - Add lines 10 and 11. (remit this amount)

LINE 2 (TOTAL LEGAL DEDUCTIONS) - Enter the amount of total

use tax deductions,

Sign and date the report and mail it with your payment in the enclosed

return envelope to:

Explanation of 'legal deductions':____________________________

______________________________________________________

OKLAHOMA TAX COMMISSION

______________________________________________________

P.O. BOX 26850

OKLAHOMA CITY, OK 73126-0850

LINE 3 (NET TAXABLE PURCHASES) - Subtract line 2 from the total

of line I to arrive at net taxable purchases. If you have no amount

subject to tax, leave blank.

WHO MUST FILE

LINE 4 (STATE TAX) - Multiply line 3 by 4.5% (.045). If there is no tax

Every consumer who is responsible for accruing and remitting payment of

due, leave blank.

Oklahoma use tax must file a Use Tax Report. Reports must be filed for

every period for which a liability exists.

LINE 5 (TAX DEDUCTION) - Enter the amount of sales and/or use tax

previously paid to another state or municipality in another state (on

WHEN TO FILE

property in line 3). Cannot exceed (4.5%) tax rate.

Reports must be postmarked on or before the 20th day of the month

LINE 6 (TAX DUE) - Subtract line 5 from line 4.

following each reporting period.

LINE 7 (INTEREST) - If this report and remittance is postmarked after

PAYMENT

the due date shown in Item C, the tax is subject to interest from the

due date (Item C) until it is paid. Multiply the amount on line 6 by the

Please send a separate check with each report submitted and put your

applicable rate for each month or part thereof that the report is late.

Taxpayer Number (Item A) on your check.

LINE 8 (PENALTY) - If this report and remittance is not postmarked

WHO TO CONTACT FOR ASSISTANCE

within 15 calendar days of the due date, a 10% penalty is due Multiply

For assistance, call (405) 521- 3160.

the tax amount on line 6 by .10 to determine the penalty.

Mandatory inclusion of Social Security and/or Federal identification

LINE 9 (SUBTOTAL) - Add lines 6, 7, and 8.

Numbers is required on forms filed with the Oklahoma Tax Commission

pursuit to Title 68 of the Oklahoma Statutes and regulations thereunder, for

Column I -

Print the name of the city or county for which you

identification purposes, and are deemed part of the confidential files and

are remitting tax.

records of the Oklahoma Tax Commission.

Column J -

Enter the "net taxable purchases" for each city or

county.

The Oklahoma Tax Commission is not required to give actual notice of

changes in any state tax law.

Changes in Business Mailing Address:

Changes in Business Location Address:

FEIN/SSN________________________________________________

FEIN/SSN_______________________________________________

NAME___________________________________________________

NAME___________________________________________________

ADDRESS_______________________________________________

ADDRESS_______________________________________________

CITY____________________________________________________

CITY____________________________________________________

STATE_____________________________ ZIP__________________

STATE_____________________________ ZIP__________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2