Emergency & Municipal Services Tax Refund Form

ADVERTISEMENT

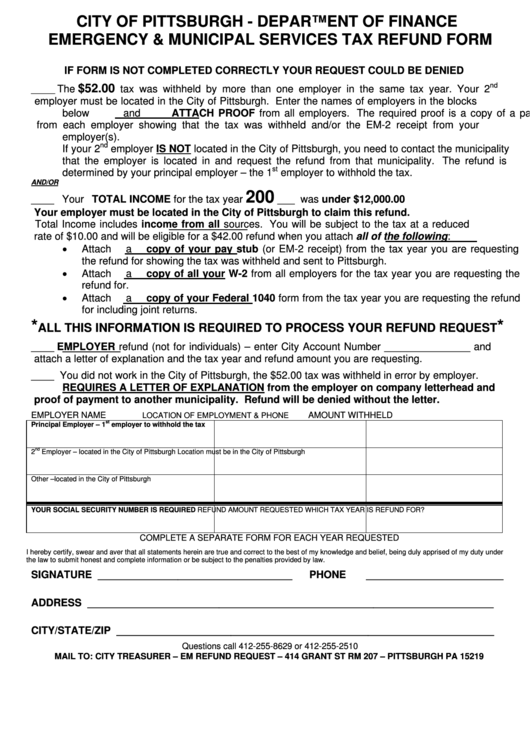

CITY OF PITTSBURGH - DEPARTMENT OF FINANCE

EMERGENCY & MUNICIPAL SERVICES TAX REFUND FORM

IF FORM IS NOT COMPLETED CORRECTLY YOUR REQUEST COULD BE DENIED

nd

$52.00

The

tax was withheld by more than one employer in the same tax year. Your 2

_____

employer must be located in the City of Pittsburgh. Enter the names of employers in the blocks

below and ATTACH PROOF from all employers. The required proof is a copy of a pay stub

from each employer showing that the tax was withheld and/or the EM-2 receipt from your

employer(s).

nd

If your 2

employer IS NOT located in the City of Pittsburgh, you need to contact the municipality

that the employer is located in and request the refund from that municipality. The refund is

st

determined by your principal employer – the 1

employer to withhold the tax.

AND/OR

200

____ Your TOTAL INCOME for the tax year

___ was under $12,000.00

Your employer must be located in the City of Pittsburgh to claim this refund.

Total Income includes income from all sources. You will be subject to the tax at a reduced

rate of $10.00 and will be eligible for a $42.00 refund when you attach all of the following:

•

Attach a copy of your pay stub (or EM-2 receipt) from the tax year you are requesting

the refund for showing the tax was withheld and sent to Pittsburgh.

•

Attach a copy of all your W-2 from all employers for the tax year you are requesting the

refund for.

•

Attach a copy of your Federal 1040 form from the tax year you are requesting the refund

for including joint returns.

*

*

ALL THIS INFORMATION IS REQUIRED TO PROCESS YOUR REFUND REQUEST

____ EMPLOYER refund (not for individuals) – enter City Account Number _______________ and

attach a letter of explanation and the tax year and refund amount you are requesting.

____ You did not work in the City of Pittsburgh, the $52.00 tax was withheld in error by employer.

REQUIRES A LETTER OF EXPLANATION from the employer on company letterhead and

proof of payment to another municipality. Refund will be denied without the letter.

EMPLOYER NAME

AMOUNT WITHHELD

LOCATION OF EMPLOYMENT & PHONE

st

Principal Employer – 1

employer to withhold the tax

nd

2

Employer – located in the City of Pittsburgh

Location must be in the City of Pittsburgh

Other –located in the City of Pittsburgh

YOUR SOCIAL SECURITY NUMBER IS REQUIRED

REFUND AMOUNT REQUESTED

WHICH TAX YEAR IS REFUND FOR?

COMPLETE A SEPARATE FORM FOR EACH YEAR REQUESTED

I hereby certify, swear and aver that all statements herein are true and correct to the best of my knowledge and belief, being duly apprised of my duty under

the law to submit honest and complete information or be subject to the penalties provided by law.

SIGNATURE __________________________________

PHONE ________________________

ADDRESS _______________________________________________________________________

CITY/STATE/ZIP __________________________________________________________________

Questions call 412-255-8629 or 412-255-2510

MAIL TO: CITY TREASURER – EM REFUND REQUEST – 414 GRANT ST RM 207 – PITTSBURGH PA 15219

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1