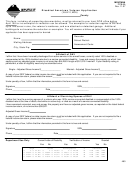

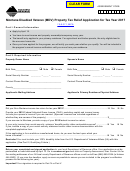

Part VII. Federal Adjusted Gross Income Calculation Worksheet

If you are not required to file a tax return, use this form to calculate your estimated federal adjusted gross income.

Income

$ _______________

Wages, salaries, tips, etc.

$ _______________

Taxable interest

$ _______________

Ordinary dividends

$ _______________

Alimony received

$ _______________

Business and/or farm income

$ _______________

Capital gain (or loss)

$ _______________

Other gain (or loss)

$ _______________

Taxable refunds, credits or offsets of state and local income taxes

$ _______________

Taxable amount of IRA distributions, pensions and annuities

$ _______________

Rental, royalties, partnerships, S corporations, trust income

$ _______________

Unemployment compensation

$ _______________

Taxable amount of social security benefits

See for calculation guidelines.

$ _______________

Other income

$ _______________

Total income

Adjustments to Income

$ _______________

Educator expenses

$ _______________

Certain business expenses of reservist

$ _______________

Health savings account deduction

$ _______________

Moving expenses

$ _______________

One-half of self-employment tax

$ _______________

Self-employed SEP, SIMPLE, and qualified plans

$ _______________

Self-employed health insurance deduction

$ _______________

Penalty on early withdrawal of savings

$ _______________

Alimony paid

$ _______________

IRA deduction

$ _______________

Student loan interest deduction

$ _______________

Tuition and fees deduction

$ _______________

Domestic production activities deduction

$ _______________

Total adjustments

Subtract:

$ ___________________ - $ ___________________ = $ __________________

Total Income

Total Adjustments

Federal Adjusted Gross Income Estimate

Questions? Please call us toll free at (866) 859-2254 (in Helena, 444-6900) or visit our website at

revenue.mt.gov.

PPB-8A

Rev. 10 12

1

1 2

2 3

3 4

4