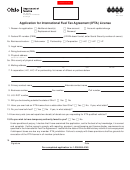

AP-178-2

PRINT FORM

CLEAR FIELDS

(Rev.8-11/13)

Texas Application for International

Instructions in English

Fuel Tax Agreement (IFTA) License

Page 1

• Please read instructions

• TYPE OR PRINT

• Do not write in shaded areas

1. Legal name of owner

(Sole owner, partnership, corporation, limited liability company, association or other legal entity)

•

2. Mailing address

(Street and number, P.O. Box or rural route and box number)

•

City

State

ZIP code

County

•

•

•

3. Enter the name and daytime phone number of the person primarily responsible for fi ling tax returns

(

)

•

Enter the email address of this person

4. Enter your Federal Employer Identifi cation (FEI) number, if any,

1

assigned to the owner entered in Item 1 .......................................................................................

5. Enter your Social Security Number (SSN) if you are a sole owner ...................................................

3

6.

Check here if you do not have either FEI or SSN.

7. Enter your taxpayer number for reporting any Texas tax OR your Texas

Vendor Identifi cation Number if you now have or have ever had one ...............................................

(Submit a copy of trust agree-

8. Indicate how your business is owned.

Sole owner

Partnership

Texas entity

Trust

ment with application.)

Foreign corporation

Limited partnership

Other (explain)

File number

File date

9. If your business is a Texas entity,

enter the fi le number and date .....................................................................

10. If your business is a foreign entity, enter home state, fi le number, Texas Certifi cate of Authority number and date.

Home state

File number

Texas Certifi cate of Authority number

Texas Certifi cate of Authority date

Home state

Partnership date

Identifi cation number

11. If your business is a limited partnership, enter the home state,

the partnership date and identifi cation number ............................

12. List all general partners or principal offi cers of your business.

If you are a sole owner, skip Item 12.

(Attach additional sheets, if necessary.)

Name (First, middle initial, last)

Social Security or Federal Employer Identifi cation (FEI) no.

Title

•

•

Home address (Street and number, city, state, ZIP code)

Phone (Area code and number)

Name (First, middle initial, last)

Social Security or Federal Employer Identifi cation (FEI) no.

Title

•

•

Home address (Street and number, city, state, ZIP code)

Phone (Area code and number)

Name (First, middle initial, last)

Social Security or Federal Employer Identifi cation (FEI) no.

Title

•

•

Home address (Street and number, city, state, ZIP code)

Phone (Area code and number)

If you purchased an existing business or business assets, complete Items 13-16. If you did not, skip to Item 17.

13. Enter the former owner's trade name. If known, enter the former owner's Texas taxpayer number.

Trade name

Taxpayer number of former owner

14. Enter the former owner's legal name. If known, enter the former owner's address and telephone number.

Legal name of former owner

Phone (Area code and number)

Address of former owner (Street and number, city, state, ZIP code)

15. Check each of the following items you purchased.

Inventory

Corporate stock

Equipment

Real estate

Other assets

16. Enter the purchase price of the business or assets purchased and the date of purchase.

Purchase price

Date of purchase

$

1

1 2

2 3

3 4

4