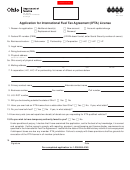

AP-178-4

(Rev.8-11/13)

Texas Application for International

Fuel Tax Agreement (IFTA) License

Page 3

• Please read instructions

• TYPE OR PRINT

• Do not write in shaded areas

32. Legal name of owner

(Same as Item 1)

•

33. Legal name of authorized agent/representative

•

34. Mailing address

City

State

ZIP code

Business number

(Area code and number)

Date of application

35. The sole owner, all general partners, corporation president, vice-president, secretary or treasurer or an autho-

Month

Day

Year

rized agent must sign this application. Representatives must submit a written power of attorney with application.

(Attach additional sheets if necessary.)

Bonds are not generally required of fi rst-time applicants. However, a bond may be required if an IFTA licensee has a history of not fi ling tax

returns on time, not remitting tax due or other problems severe enough to indicate that a bond is required to protect the interests of all member

jurisdictions.

The applicant agrees to comply with reporting, payment, record keeping and license and decal display requirements as specifi ed in the Interna-

tional Fuel Tax Agreement. The applicant further agrees that Texas may withhold any refunds due if applicant is delinquent on payment of fuel

taxes due any member jurisdiction. Failure to comply with these provisions shall be grounds for revocation of license in all member jurisdictions.

I (We) certify that the information in this document and any attachment is true, accurate and complete to the best of my (our) knowledge. I (We)

acknowledge that any falsifi cation of document information subjects me (us) to civil and/or criminal sanctions of the state of Texas.

Type or print name and title of sole owner, partner, offi cer or authorized agent

Sole owner, partner, offi cer or authorized agent

Type or print name and title of partner or offi cer

Partner or offi cer

Type or print name and title of partner or offi cer

Partner or offi cer

WARNING: You may be required to obtain an additional permit or license from the State of Texas or from a local governmental entity

to conduct business. A listing of links relating to acquiring licenses, permits, and registrations from the State of Texas is available

online at You may also want to contact the municipality and county in which you will conduct business to

determine any local governmental requirements.

1

1 2

2 3

3 4

4