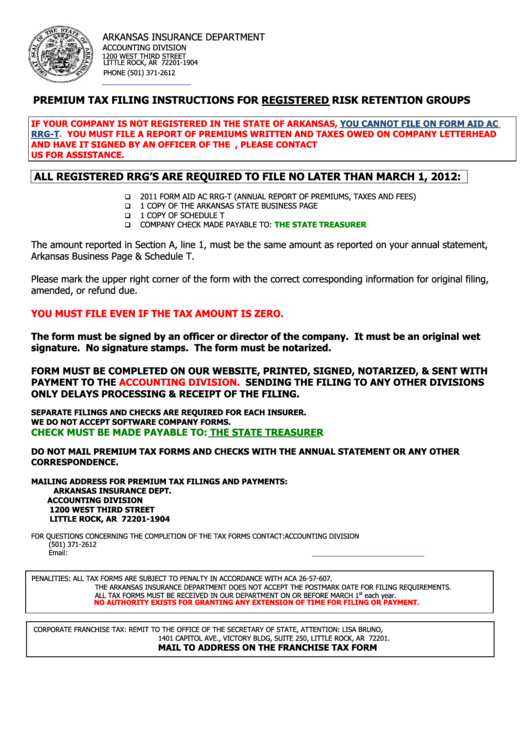

ARKANSAS INSURANCE DEPARTMENT

ACCOUNTING DIVISION

1200 WEST THIRD STREET

LITTLE ROCK, AR 72201-1904

PHONE (501) 371-2612

PREMIUM TAX FILING INSTRUCTIONS FOR REGISTERED RISK RETENTION GROUPS

IF YOUR COMPANY IS NOT REGISTERED IN THE STATE OF ARKANSAS,

YOU CANNOT FILE ON FORM AID AC

RRG-T.

YOU MUST FILE A REPORT OF PREMIUMS WRITTEN AND TAXES OWED ON COMPANY LETTERHEAD

AND HAVE IT SIGNED BY AN OFFICER OF THE COMPANY. IF YOU ARE UNSURE ABOUT THIS, PLEASE CONTACT

US FOR ASSISTANCE.

ALL REGISTERED RRG’S ARE REQUIRED TO FILE NO LATER THAN MARCH 1, 2012:

2011 FORM AID AC RRG-T (ANNUAL REPORT OF PREMIUMS, TAXES AND FEES)

1 COPY OF THE ARKANSAS STATE BUSINESS PAGE

1 COPY OF SCHEDULE T

COMPANY CHECK MADE PAYABLE TO:

THE STATE TREASURER

The amount reported in Section A, line 1, must be the same amount as reported on your annual statement,

Arkansas Business Page & Schedule T.

Please mark the upper right corner of the form with the correct corresponding information for original filing,

amended, or refund due.

YOU MUST FILE EVEN IF THE TAX AMOUNT IS ZERO.

The form must be signed by an officer or director of the company. It must be an original wet

signature. No signature stamps. The form must be notarized.

FORM MUST BE COMPLETED ON OUR WEBSITE, PRINTED, SIGNED, NOTARIZED, & SENT WITH

PAYMENT TO THE

ACCOUNTING DIVISION.

SENDING THE FILING TO ANY OTHER DIVISIONS

ONLY DELAYS PROCESSING & RECEIPT OF THE FILING.

SEPARATE FILINGS AND CHECKS ARE REQUIRED FOR EACH INSURER.

WE DO NOT ACCEPT SOFTWARE COMPANY FORMS.

CHECK MUST BE MADE PAYABLE TO: THE STATE TREASURER

DO NOT MAIL PREMIUM TAX FORMS AND CHECKS WITH THE ANNUAL STATEMENT OR ANY OTHER

CORRESPONDENCE.

MAILING ADDRESS FOR PREMIUM TAX FILINGS AND PAYMENTS:

ARKANSAS INSURANCE DEPT.

ACCOUNTING DIVISION

1200 WEST THIRD STREET

LITTLE ROCK, AR 72201-1904

FOR QUESTIONS CONCERNING THE COMPLETION OF THE TAX FORMS CONTACT: ACCOUNTING DIVISION

(501) 371-2612

Email:

Insurance.Accounting@arkansas.gov

PENALITIES:

ALL TAX FORMS ARE SUBJECT TO PENALTY IN ACCORDANCE WITH ACA 26-57-607.

THE ARKANSAS INSURANCE DEPARTMENT DOES NOT ACCEPT THE POSTMARK DATE FOR FILING REQUIREMENTS.

st

ALL TAX FORMS MUST BE RECEIVED IN OUR DEPARTMENT ON OR BEFORE MARCH 1

each year.

NO AUTHORITY EXISTS FOR GRANTING ANY EXTENSION OF TIME FOR FILING OR PAYMENT.

CORPORATE FRANCHISE TAX: REMIT TO THE OFFICE OF THE SECRETARY OF STATE, ATTENTION: LISA BRUNO,

1401 CAPITOL AVE., VICTORY BLDG, SUITE 250, LITTLE ROCK, AR 72201.

MAIL TO ADDRESS ON THE FRANCHISE TAX FORM

1

1 2

2 3

3